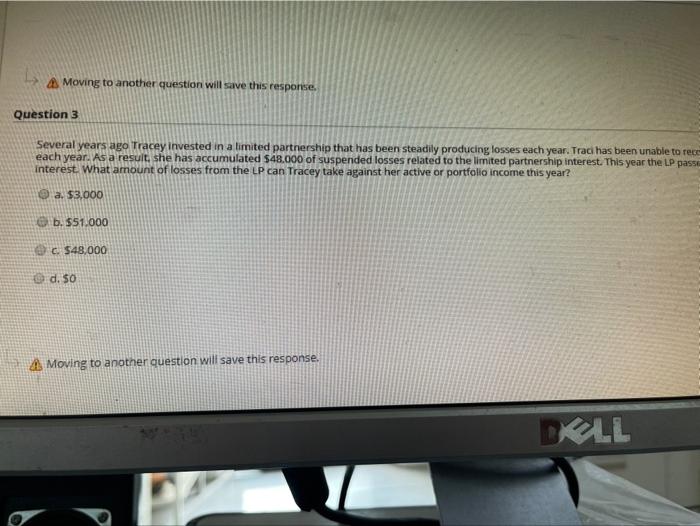

Question: Moving to another question will save this response. Question 3 Several years ago Tracey invested in a limited partnership that has been steadily producing losses

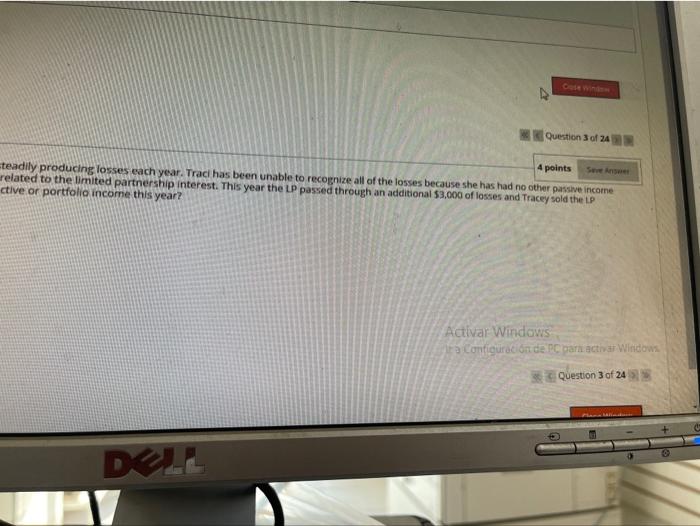

Moving to another question will save this response. Question 3 Several years ago Tracey invested in a limited partnership that has been steadily producing losses each year. Traci has been unable to rece each year. As a result, she has accumulated $48.000 of suspended losses related to the limited partnership interest. This year the LP passe interest. What amount of losses from the LP can Tracey take against her active or portfolio income this year? a $3,000 b. $51.000 c. $48,000 d. $0 Moving to another question will save this response. KULL Case Question 3 of 24 4 points teadily producing losses each year. Traci has been unable to recognize all of the losses because she has had no other passive income related to the limited partnership interest. This year the LP passed through an additional $3,000 of losses and Tracey sold the LP ctive or portfolio income this year? Activar Windows a configuracin de para activar Windows Question 3 of 245 DOLL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts