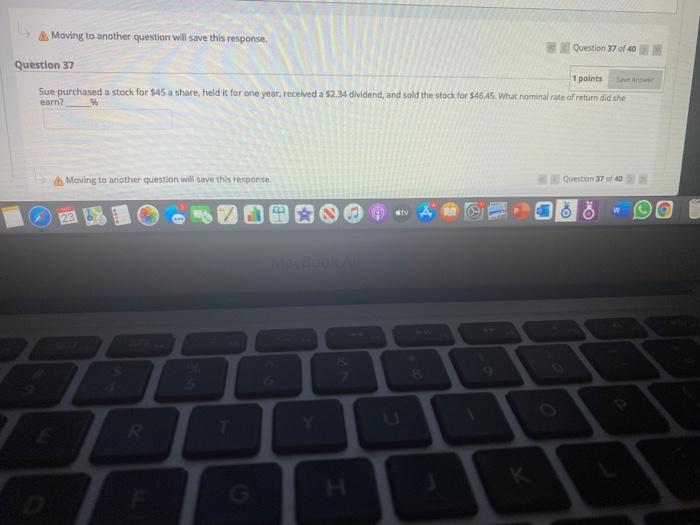

Question: Moving to another question will save this response. Question 37 of 40 Question 37 1 points Sue purchased a stock for $45 a share, held

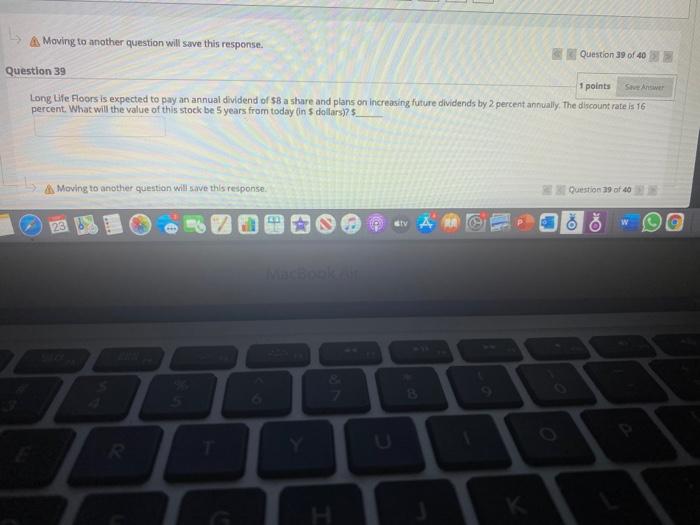

Moving to another question will save this response. Question 37 of 40 Question 37 1 points Sue purchased a stock for $45 a share, held it for one year, received a 52.34 dividend, and sold the stock for $46.45. What nominal rate of return did she earn? Moving to another question will save this response. Question 37 of 40 w 23 R Moving to another question will save this response. Question 39 of 403 Question 39 1 points Save Answer Long Life Foors is expected to pay an annual dividend of $8 a share and plans on increasing future dividends by 2 percent annually. The discount rate is 16 percent. What will the value of this stock be 5 years from today on S dollars)? Moving to another question will save this response Question 39 of 40 gy w 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts