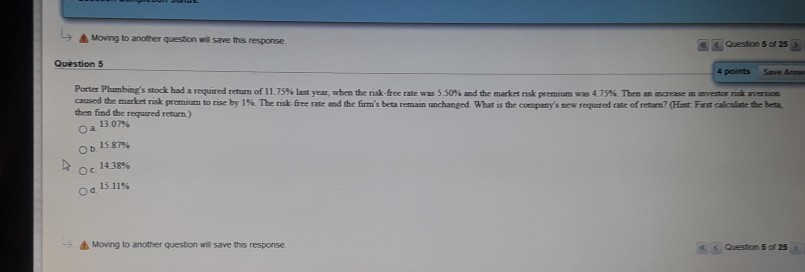

Question: Moving to another question will save this response Question 5 of 25 Question 5 4 points Save As. Portes Plumbing's stock had a required return

Moving to another question will save this response Question 5 of 25 Question 5 4 points Save As. Portes Plumbing's stock had a required return of 1.75% last year, when the risk-free rate was 5 50% and the market risk premium was 4.75%. Then an increase in investor nickerson caused the market risk premium to rise by 15. The risk free rate and the firm's beta remain unchanged. What is the company's new required rate of return? (Hint. Forst calculate the beta then find the required return) 13.0796 Oa Ob 15.87% 14.389 Od 15.11% Moving to another question will save this response Question 5 of 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts