Question: Moving to another question will save this response. Question 7 A manufacturing company is considering to buy one from two alternative machines. Machine A will

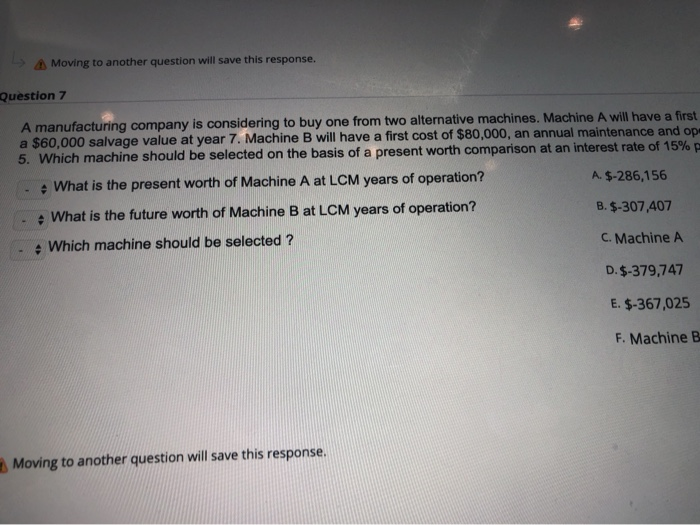

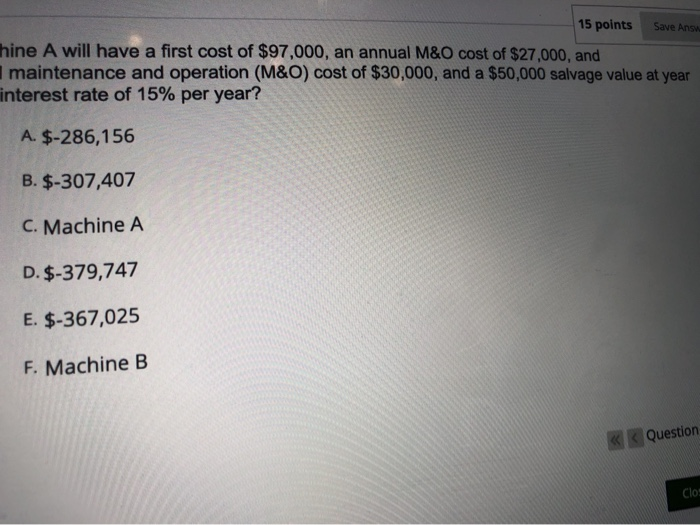

Moving to another question will save this response. Question 7 A manufacturing company is considering to buy one from two alternative machines. Machine A will have a first a $60,000 salvage value at year 7. Machine B will have a first cost of $80,000, an annual maintenance and op 5. Which machine should be selected on the basis of a present worth comparison at an interest rate of 15% What is the present worth of Machine A at LCM years of operation? A. $-286,156 What is the future worth of Machine B at LCM years of operation? B. $-307,407 Which machine should be selected ? C. Machine A D. $-379,747 E. $-367,025 F. Machine B Moving to another question will save this response. Save Answ 15 points hine A will have a first cost of $97,000, an annual M&O cost of $27,000, and maintenance and operation (M&O) cost of $30,000, and a $50,000 salvage value at year interest rate of 15% per year? A. $-286,156 B. $-307,407 C. Machine A D. $-379,747 E. $-367,025 F. Machine B Question Clo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts