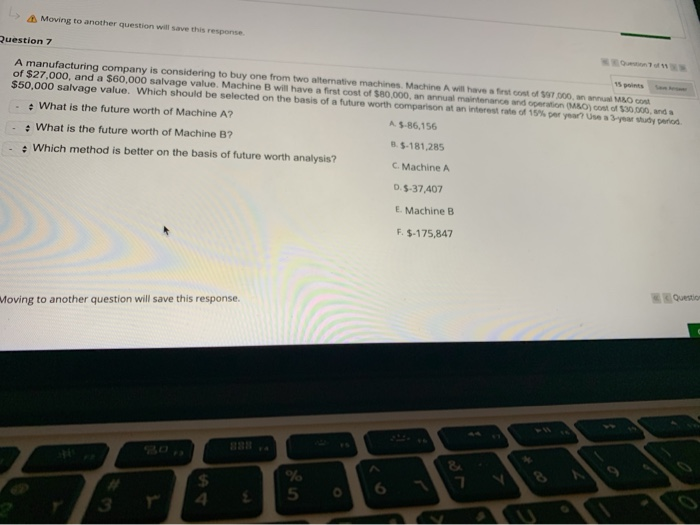

Question: Moving to another question will save this response Question 7 A manufacturing company is considering to buy one from two alternative machines Machine A will

Moving to another question will save this response Question 7 A manufacturing company is considering to buy one from two alternative machines Machine A will have a festcoto 00, MO of $27,000, and a $60,000 salvage value. Machine B will have a first cost of $80,000, an annual maintenance and certion ( MO) of $30,000, and a $50,000 salvage value. Which should be selected on the basis of a future worth comparison at an interest rate of 15% per year on a year to What is the future worth of Machine A? A $-86,156 What is the future worth of Machine B? 55-181,285 Which method is better on the basis of future worth analysis? C. Machine A 0.5-37,407 E. Machine B F. $-175,847 Moving to another question will save this response. $ % 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts