Question: Moving to another question will save this response. Question 9 Which of Nike's balance sheet accounts represents future cash outflows for expenses already incurred? O

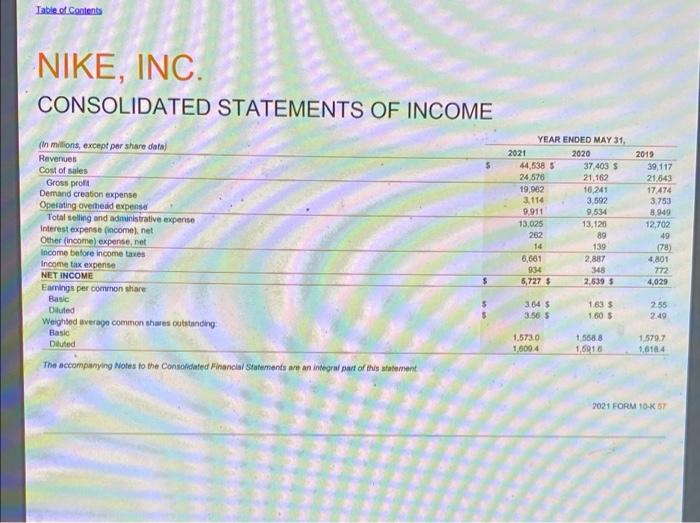

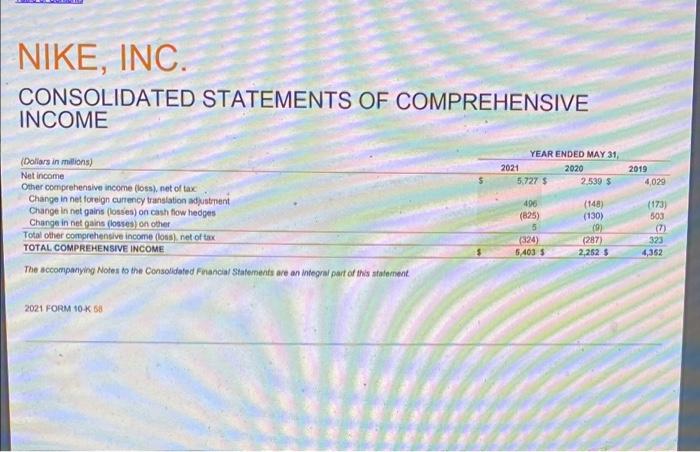

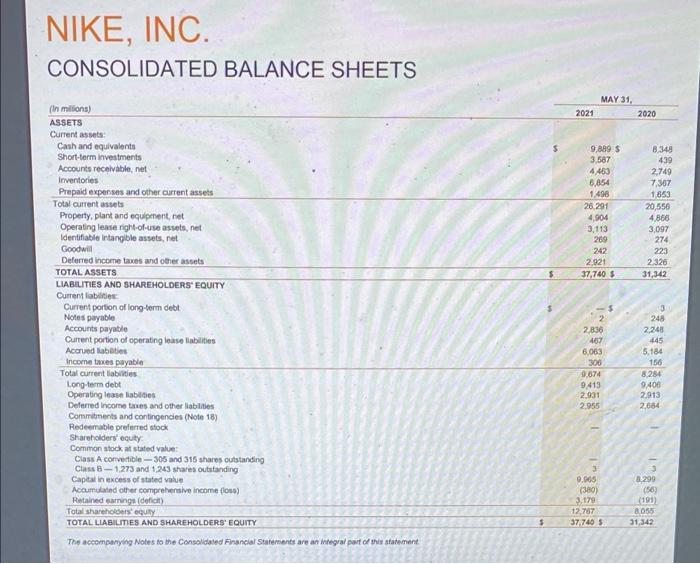

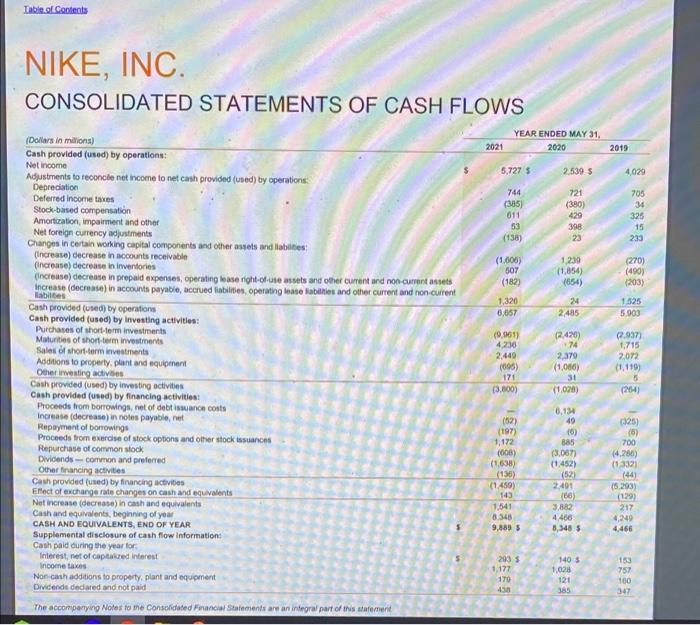

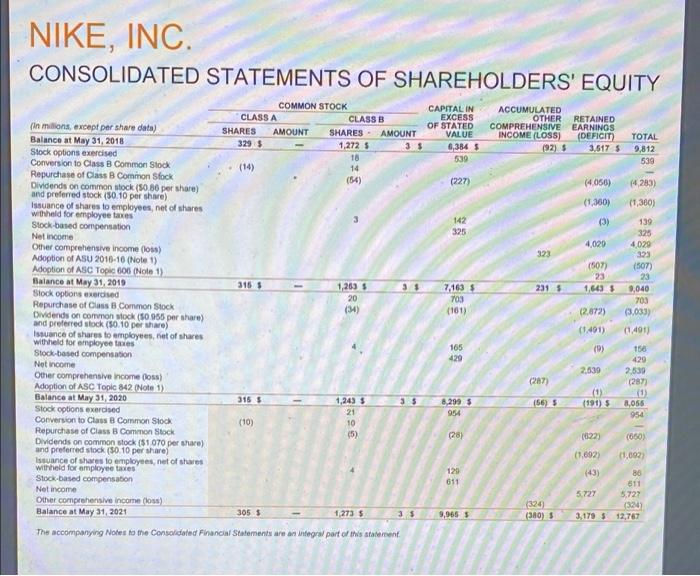

Moving to another question will save this response. Question 9 Which of Nike's balance sheet accounts represents future cash outflows for expenses already incurred? O a. Accounts receivable. O b. Accounts payable. Oc. Current portion of long-term debt. O d. Accrued liabilities. Table of Contents NIKE, INC. CONSOLIDATED STATEMENTS OF INCOME (In millions, except per share data) 2021 Revenues $ Cost of sales Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense (income), net Other (income) expense, net Income before income taxes Income tax expense NET INCOME Eamings per common share Basic Diluted Weighted average common shares outstanding Basic Diluted The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement S S $ YEAR ENDED MAY 31, 2020 37,403 S 21,162 16,241 3,592 9,534 13,126 89 139 2,887 348 2,539 S 1.63 $ 1.60 $ 44,538 24,576 19,962 3,114 9,911 13,025 262 14 6,661 934 5,727 $ 3.64 $ 3.56 $ 1,573.0 1,600.4 2019 1,566.8 1.6016 39,117 21,643 17474 3,753 8,949 12,702 49 (78) 4,801 772 4,029 2.55 2.49 1,579.7 1,6184 2021 FORM 10-K 57 NIKE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME YEAR ENDED MAY 31, (Dollars in millions) 2021 2020 Net income 2,539 $ Other comprehensive income (loss), net of tax Change in net foreign currency translation adjustment (148) Change in net gains (losses) on cash flow hedges (130) Change in net gains (losses) on other (9) Total other comprehensive income (loss), net of tax (287) TOTAL COMPREHENSIVE INCOME 2,252 $ The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement 2021 FORM 10-K 58 5,727 $ 496 (825) 5 (324) 5,403 S 2019 4,029 (173) 503 (7) 323 4,352 NIKE, INC. CONSOLIDATED BALANCE SHEETS (In millions) ASSETS Current assets: Cash and equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Operating lease right-of-use assets, net Identifiable intangible assets, net Goodwill Deferred income taxes and other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term debt Notes payable Accounts payable Current portion of operating lease liabilities Accrued liabilities Income taxes payable Total current liabilities Long-term debt Operating lease liables Deferred Income taxes and other liabilities Commitments and contingencies (Note 18) Redeemable preferred stock Shareholders' equity Common stock at stated value: Class A convertible-305 and 315 shares outstanding Class B-1,273 and 1,243 shares outstanding Capital in excess of stated value Accumulated other comprehensive income (loss) Retained earnings (deficit) Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement $ $ $ 2021 MAY 31, 9,889 $ 3,587 4,463 6,854 1,496 26,291 4,904 3,113 269 242 2,921 37,740 $ 2,836 467 6,063 306 9,674 9,413 2.931 2.955 9.965 (380) 3,179 12,767 37,740 S 2020 8,348 439 2,749 7,307 1,653 20,556 4,866 3,097 274 223 2.326 31,342 3 248 2,248 445 5,184 156 8,284 9,406 2.913 2,684 1 8,299 (56) (191) 8.055 31,342 Table of Contents NIKE, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars in millions) 2021 Cash provided (used) by operations: Net income Adjustments to reconcile net income to net cash provided (used) by operations Depreciation Deferred income taxes Stock-based compensation Amortization, impairment and other Net foreign currency adjustments Changes in certain working capital components and other assets and abilities: (Increase) decrease in accounts receivable (increase) decrease in inventories (increase) decrease in prepaid expenses, operating lease right-of-use assets and other cument and non-current assets Increase (decrease) in accounts payable, accrued liabilities, operating lease abilities and other current and non-current labiltes Cash provided (used) by operations Cash provided (used) by Investing activities: Purchases of short-term investments Maturities of short-term investments Sales of short-term investments Additions to property, plant and equipment Other investing activities Cash provided (used) by investing activities Cash provided (used) by financing activities: Proceeds from borrowings, net of debt issuance costs Increase (decrease) in notes payable, net Repayment of borrowings Proceeds from exercise of stock options and other stock issuances Repurchase of common stock Dividends common and preferred Other financing activities Cash provided (used) by financing activities Effect of exchange rate changes on cash and equivalents Net increase (decrease) in cash and equivalents Cash and equivalents, beginning of year CASH AND EQUIVALENTS, END OF YEAR Supplemental disclosure of cash flow information: Cash paid during the year for Interest, net of capitalized interest Income taxes Non cash additions to property, plant and equipment Dividends declared and not paid The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement YEAR ENDED MAY 31, 2020 2,539 S 721 (380) 429 398 23 1,239 (1,854) (654) 24 2,485 (2,420) 74 2,379 (1,066) 31 (1.028) 6,134 49 (6) 885 (3,067) (1,452) (52) 2,491 (66) 3,882 4,466 8,348 $ 140 1,028 121 385 5,727 $ 744 (385) 011 53 (138) (1,000) 507 (182) 1,320 6,657 (9,901) 4,236 2,449 (095) 171 (3.000) (52) (197) 1,172 (608) (1,638) (136) (1459) 143 1,541 8.348 9,880 S 293 S 1,177 170 438 2019 4,029 705 34 325 15 233 (270) (490) (203) 1.525 5,903 (2.937) 1,715 2.072 (1,119) 5 (264) (325) (6) 700 (4,286) (1332) (44) (5.293) (129) 217 4,249 4,466 153 757 100 347 NIKE, INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY COMMON STOCK CAPITAL IN ACCUMULATED CLASS A CLASS B EXCESS OF STATED OTHER RETAINED COMPREHENSIVE EARNINGS INCOME (LOSS) AMOUNT SHARES AMOUNT VALUE (DEFICIT) TOTAL (in millions, except per share data) Balance at May 31, 2018 Stock options exercised SHARES 329 S 1,272 S 35 6,384 S 3,517 S 9,812 18 539 539 (14) 14 Conversion to Class B Common Stock Repurchase of Class B Common Stock Dividends on common stock ($0,86 per share) and preferred stock (50.10 per share) (54) (227) (4,056) (4,283) (1,360) (1,360) Issuance of shares to employees, net of shares withheld for employee taxes 142 (3) 139 Stock-based compensation Net income 325 325 4,029 323 Other comprehensive income (loss) Adoption of ASU 2016-16 (Note 1)) Adoption of ASC Topic 606 (Note 1) Balance at May 31, 2019 (507) 23 315 S 7,163 9,040 Stock options exercised 703 703 (161) (3,033) Repurchase of Class B Common Stock Dividends on common stock ($0 955 per share) and preferred stock (50.10 per share) (1491) Issuance of shares to employees, net of shares withheld for employee taxes Stock-based compensation 165 156 429 429 Net income 2,539 Other comprehensive income (loss) Adoption of ASC Topic 842 (Note 1) Balance at May 31, 2020 315 S 8,299 S Stock options exercised 954 Conversion to Class B Common Stock (10) Repurchase of Class B Common Stock (28) Dividends on common stock ($1,070 per share) i and preferred stock (30.10 per share) Issuance of shares to employees, net of shares withheld for employee taxes 129 611 Stock-based compensation Net income Other comprehensive income (loss) Balance at May 31, 2021 305 $ 1,273 35 9,965 $ The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement 1,263 20 (34) 1,243 21 10 (5) 3$ 35 323 231 S (287) (56) (324) (380) S 4,029 (507) 23 1,643 (2,872) (1.491) (9) 2,539 (287) (1) (1) (191) S 8,055 954 (622) (650) (1,092) (1,092) (43) 86 611 5,727 5,727 (324) 3,179 $ 12,767

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts