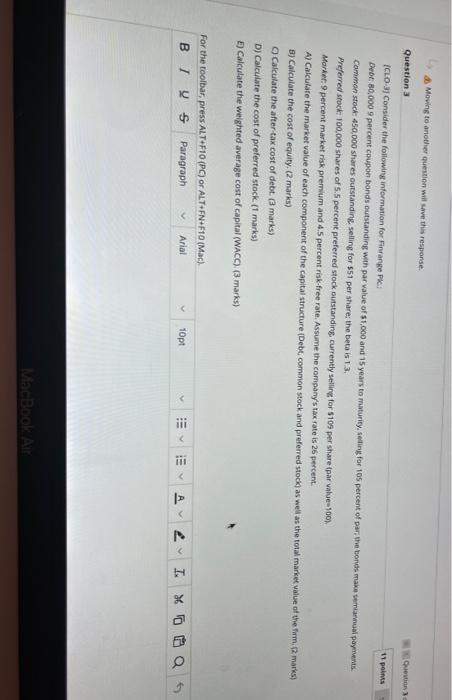

Question: Moving to another question will save this response Question Question 3 11 points ICLO 3 Consider the following information for Finrange PC: Dede 10.000 9

Moving to another question will save this response Question Question 3 11 points ICLO 3 Consider the following information for Finrange PC: Dede 10.000 9 percent coupon bonds outstanding with par value of $1.000 and 15 years to maturity, selling for 105 percent of par, the bonds make semanual payments Common stock 450,000 shares outstanding selling for 551 per share the beta is 13. Preferred stock: 100.000 shares of 5.5 percent preferred stock outstanding currently selling for $109 per share (par value100) Market: 9 percent market risk premium and 4.5 percent risk-free rate. Assume the company's tax rate is 26 percent. A) Calculate the market value of each component of the capital structure (Debt common stock and preferred stock as well as the total market value of the firm.2 marks) B) Calculate the cost of equity. (2 marks) Calculate the after-tax cost of debt. (3 marks) D) Calculate the cost of preferred stock. (1 marks) E) Calculate the weighted average cost of capital (WACC),(3 marks) For the toolbar, press ALT+F10 (PC) or ALT+FNF10 (Mac) BTU $ Paragraph Arial v 10pt A 2 N I. XO a MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts