Question: Moving to another question will save this response. Question stion 22 1 point Cady Construction received a contract to construct a hospital for $2,500,000. Construction

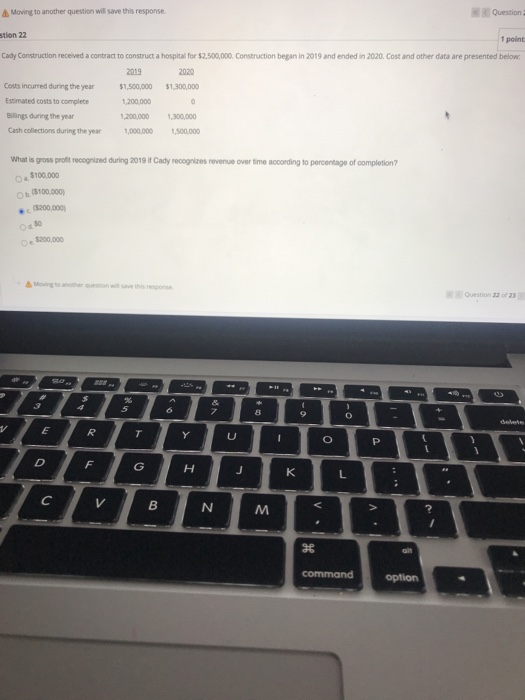

Moving to another question will save this response. Question stion 22 1 point Cady Construction received a contract to construct a hospital for $2,500,000. Construction began in 2019 and ended in 2020. Cost and other data are presented below. 2019 2020 $1,500,000 $1.300.000 1,200.000 Costs incurred during the year Estimated costs to complete Billings during the year Cash collections during the year 1,200,000 1,000,000 1,300,000 1,500,000 What is gross profit recognized during 2019 i Cady recognizes revenue over time according to percentage of completion? 0 $100.000 ($100.000 (5200,000 $200.000 Question 22 23 -- & 5 & 8 9 0 V E T Y U 1 o P 1 D F G H K L : C V B N V M 38 command option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts