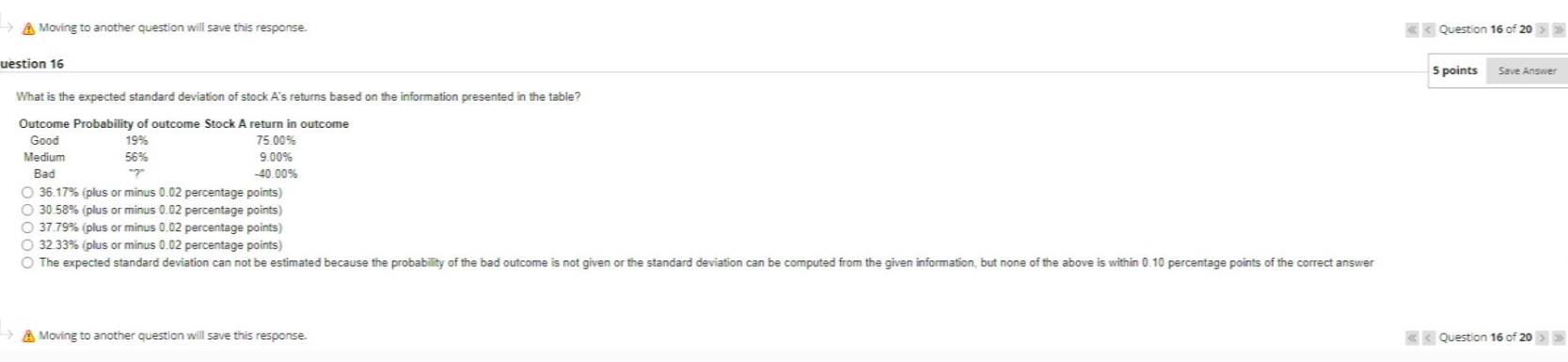

Question: Moving to another question will save this response. uestion 16 What is the expected standard deviation of stock A's returns based on the information presented

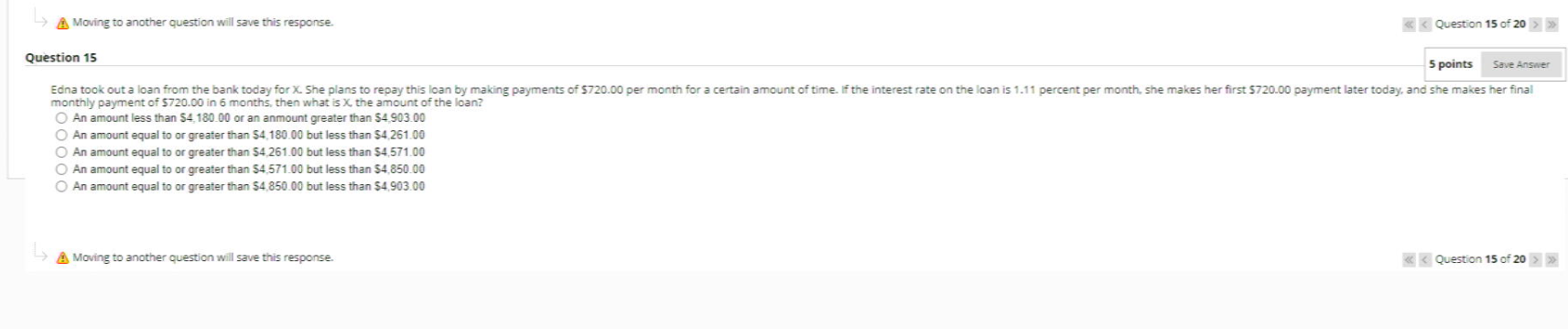

Moving to another question will save this response. uestion 16 What is the expected standard deviation of stock A's returns based on the information presented in the table? Outcome Probability of outcome Stock A return in outcome Good 19% 56% Medium Bad 75.00% 9.00% -40.00% O 36.17% (plus or minus 0.02 percentage points) O 30.58% (plus or minus 0.02 percentage points) O 37.79% (plus or minus 0.02 percentage points) O 32.33% (plus or minus 0.02 percentage points) O The expected standard deviation can not be estimated because the probability of the bad outcome is not given or the standard deviation can be computed from the given information, but none of the above is within 0.10 percentage points of the correct answer A Moving to another question will save this response. Question 16 of 20 5 points Save Answer >>> Moving to another question will save this response. Question 15 5 points Save Answer Edna took out a loan from the bank today for X. She plans to repay this loan by making payments of $720.00 per month for a certain amount of time. If the interest rate on the loan is 1.11 percent per month, she makes her first $720.00 payment later today, and she makes her final monthly payment of $720.00 in 6 months, then what is X, the amount of the loan? O An amount less than $4,180.00 or an anmount greater than $4,903.00 O An amount equal to or greater than $4,180.00 but less than $4,261.00 O An amount equal to or greater than $4,261.00 but less than $4,571.00 O An amount equal to or greater than $4.571.00 but less than $4,850.00 O An amount equal to or greater than $4,850.00 but less than $4,903.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts