Question: Moving to another question will save ussip uestion 27 12 points Project A has an initial cost of $150.000 and provides cash inflows of (-

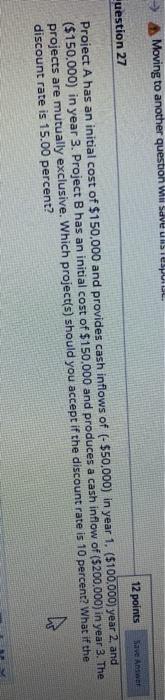

Moving to another question will save ussip uestion 27 12 points Project A has an initial cost of $150.000 and provides cash inflows of (- $50.000) in year 1. ($100.000) year 2, and ($150.000) in year 3. Project B has an initial cost of $150.000 and produces a cash inflow of ($200,000) in year 3. The projects are mutually exclusive. Which project(s) should you accept if the discount rate is 10 percent? What if the discount rate is 15.00 percent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock