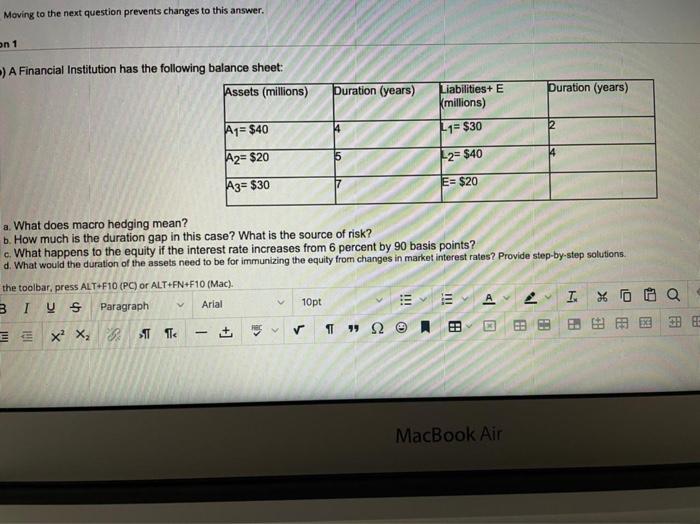

Question: Moving to the next question prevents changes to this answer. on 1 -) A Financial Institution has the following balance sheet: Assets (millions) Duration (years)

Moving to the next question prevents changes to this answer. on 1 -) A Financial Institution has the following balance sheet: Assets (millions) Duration (years) Duration (years) Liabilities+ E Kmillions) A1= $40 -1= $30 A2= $20 |-2= $40 A3= $30 E= $20 a. What does macro hedging mean? b. How much is the duration gap in this case? What is the source of risk? c. What happens to the equity if the interest rate increases from 6 percent by 90 basis points? d. What would the duration of the assets need to be for immunizing the equity from changes in market interest rates? Provide step-by-step solutions the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). 3 IV S Paragraph Arial 10pt A 2 I. 3 X XT TTC V 13 MacBook Air Moving to the next question prevents changes to this answer. on 1 -) A Financial Institution has the following balance sheet: Assets (millions) Duration (years) Duration (years) Liabilities+ E Kmillions) A1= $40 -1= $30 A2= $20 |-2= $40 A3= $30 E= $20 a. What does macro hedging mean? b. How much is the duration gap in this case? What is the source of risk? c. What happens to the equity if the interest rate increases from 6 percent by 90 basis points? d. What would the duration of the assets need to be for immunizing the equity from changes in market interest rates? Provide step-by-step solutions the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). 3 IV S Paragraph Arial 10pt A 2 I. 3 X XT TTC V 13 MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts