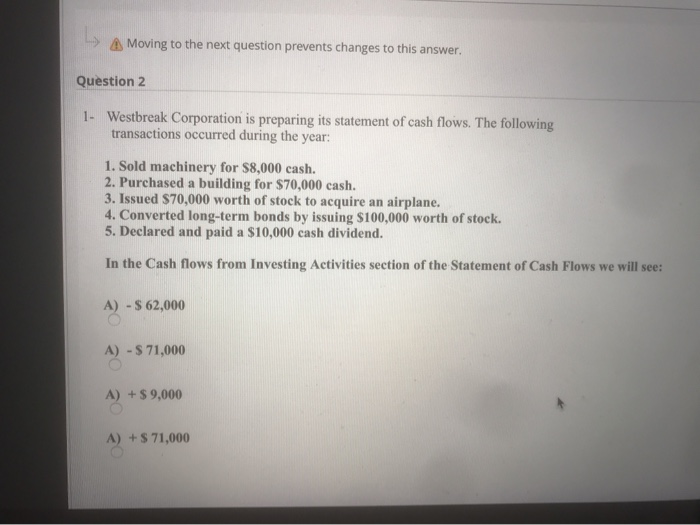

Question: Moving to the next question prevents changes to this answer. Question 2 1- Westbreak Corporation is preparing its statement of cash flows. The following transactions

Moving to the next question prevents changes to this answer. Question 2 1- Westbreak Corporation is preparing its statement of cash flows. The following transactions occurred during the year: 1. Sold machinery for $8,000 cash. 2. Purchased a building for $70,000 cash. 3. Issued $70,000 worth of stock to acquire an airplane. 4. Converted long-term bonds by issuing $100,000 worth of stock. 5. Declared and paid a $10,000 cash dividend. In the Cash flows from Investing Activities section of the Statement of Cash Flows we will see: A) - $ 62,000 A) - $ 71,000 A) + $ 9,000 + $ 71,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts