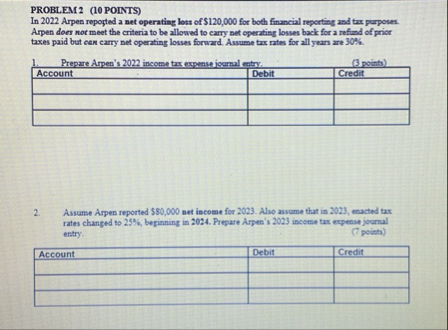

Question: PROBLEM 2 ( 1 0 POINTS ) In 2 0 2 2 Arpen repogted a net operating loss of $ 1 2 0 , 0

PROBLEM POINTS

In Arpen repogted a net operating loss of $ for both financial reporting and tax porposes. Arpen does not meet the criteria to be allowed to carry net operating lonses back for a refind of prior taxes paid but cen carry net operating losses forward. Ausume tax rates for all years are

Prepare Arpen's income tax expmne ioumal entry. poins

tableAccountDebit,Credit

Ausume Arpen reported net income for Also assume that in enacted tax rates changed to beginning in Prepare Arpen's income tax expense journal entry.

points

tableAccountDebit,Credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock