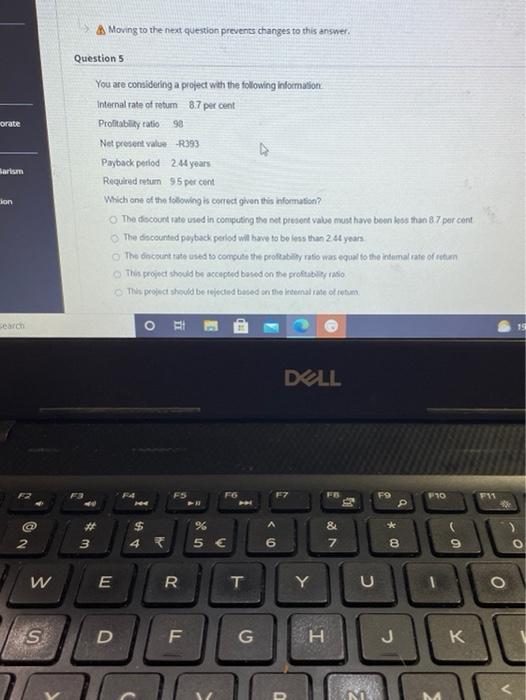

Question: Moving to the next question prevents changes to this answer. Question 5 orate arism You are considering a project with the following information Internal rate

Moving to the next question prevents changes to this answer. Question 5 orate arism You are considering a project with the following information Internal rate of retum 8.7 per cent Profitability ratio 98 Net present value-R393 Payback period 2.44 years Required return 95 per cont Which one of the following is correct given this information? o The discount rate used in competing the set present also must have boon koos than 8.7 percent The discounted payback period we have to be less than 20 years The oncount rate used to compute the profitability ratio was equal to the intamal rate of retum This project should be accepted based on the profitability ratio This project should be rejected based on the real rate om lon earch o i E TED 19 DELL FO F7 FB FO P F10 FY 3 Si # NO w $ 96 5 & 7 m 4 U 6 0 O 8 9 o W E R T Y U o o S D F G H J v

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts