Question: Moving to the next question prevents changes to this answer Question 13 of 20 Question 13 5 points A major auto manufacturer has experienced a

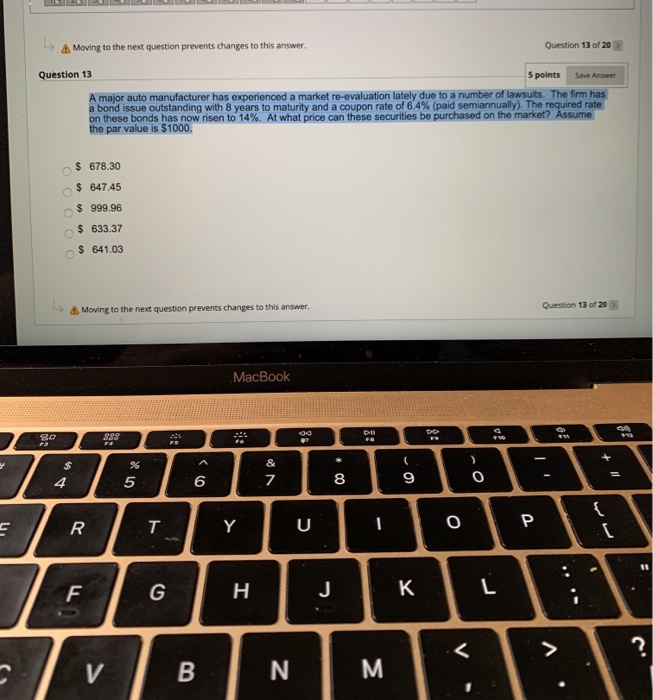

Moving to the next question prevents changes to this answer Question 13 of 20 Question 13 5 points A major auto manufacturer has experienced a market re-evaluation lately due to a number of lawsuits. The firm has a bond issue outstanding with 8 years to maturity and a coupon rate of 6.4% (paid semiannually). The required rate on these bonds has now risen to 14%. At what price can these securities be purchased on the market? Assume the par value is $1000. OO $ 678.30 $ 647.45 $ 999.96 $ 633.37 $ 641.03 Moving to the next question prevents changes to this answer. Question 13 of 20 MacBook

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts