Question: MP managers states additional revenues will be 300,000 per year. Capital expenditure on the new items would amount to 950,000. The managers estimate that additional

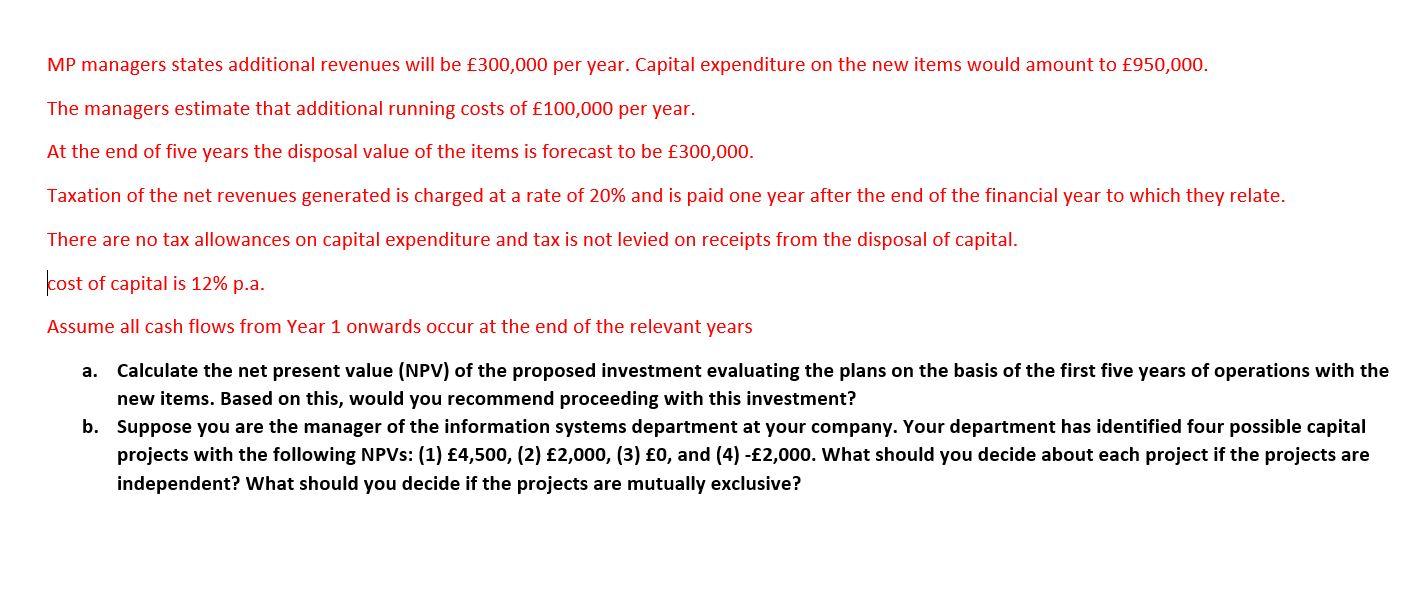

MP managers states additional revenues will be 300,000 per year. Capital expenditure on the new items would amount to 950,000. The managers estimate that additional running costs of 100,000 per year. At the end of five years the disposal value of the items is forecast to be 300,000. Taxation of the net revenues generated is charged at a rate of 20% and is paid one year after the end of the financial year to which they relate. There are no tax allowances on capital expenditure and tax is not levied on receipts from the disposal of capital. cost of capital is 12% p.a. Assume all cash flows from Year 1 onwards occur at the end of the relevant years a. Calculate the net present value (NPV) of the proposed investment evaluating the plans on the basis of the first five years of operations with the new items. Based on this, would you recommend proceeding with this investment? b. Suppose you are the manager of the information systems department at your company. Your department has identified four possible capital projects with the following NPVs: (1) 4,500, (2) 2,000, (3) 0, and (4) -2,000. What should you decide about each project if the projects are independent? What should you decide if the projects are mutually exclusive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts