Question: MPJ Corp. has determined that it should work to create an optimal capital structure which is composed of the following sources, their cost (after-tax when

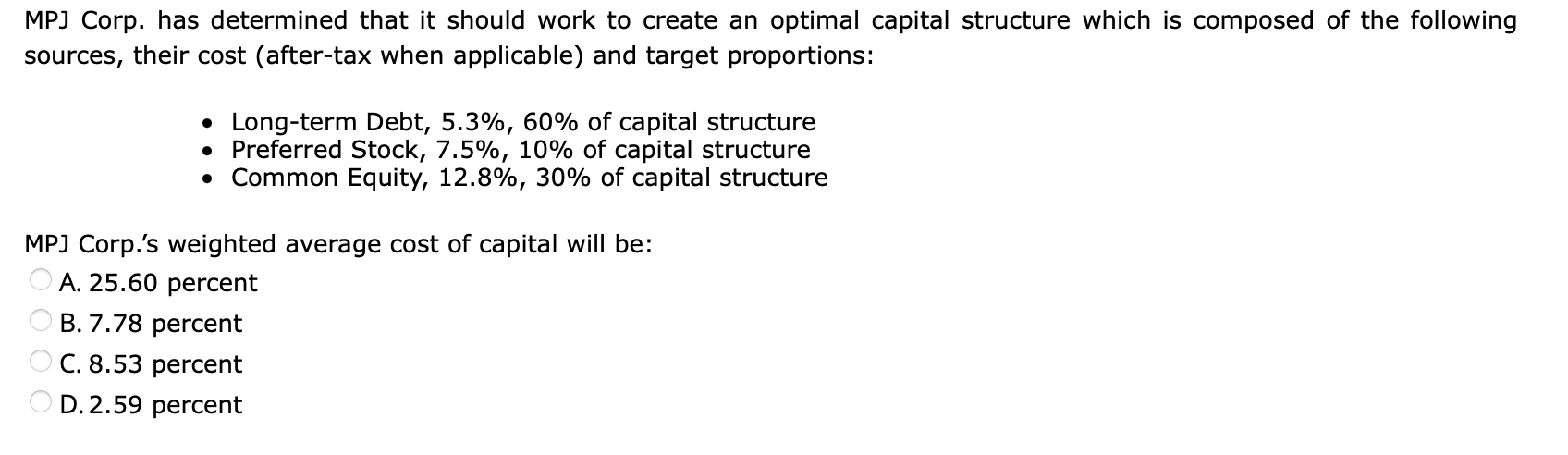

MPJ Corp. has determined that it should work to create an optimal capital structure which is composed of the following sources, their cost (after-tax when applicable) and target proportions: Long-term Debt, 5.3%, 60% of capital structure Preferred Stock, 7.5%, 10% of capital structure Common Equity, 12.8%, 30% of capital structure MPJ Corp.'s weighted average cost of capital will be: A. 25.60 percent B. 7.78 percent C. 8.53 percent D. 2.59 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts