Question: Mr . and Mrs . Goodwill are considering refinancing their mortgage to consolidate their current debts as they are having difficulties in paying the monthly

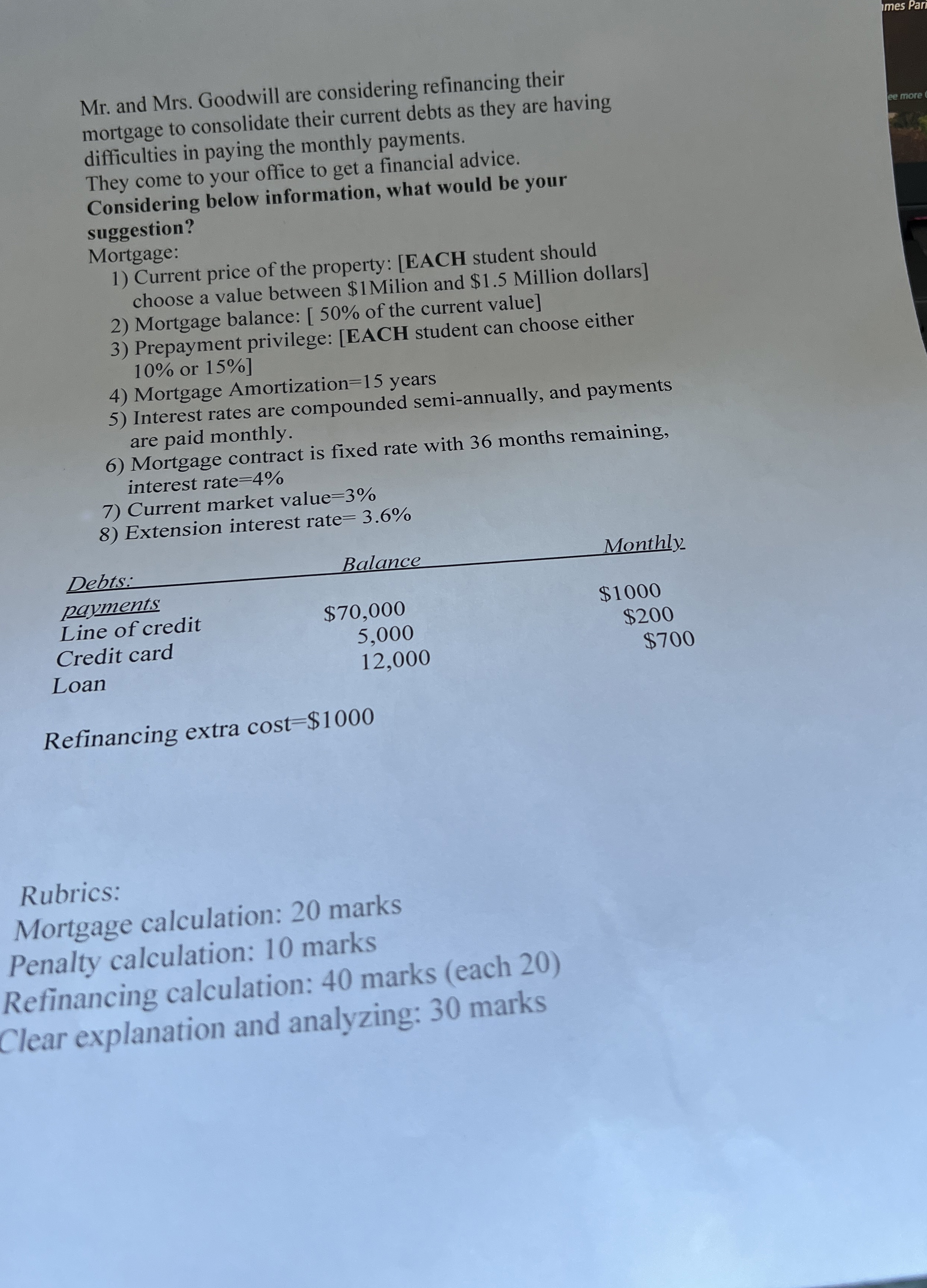

Mr and Mrs Goodwill are considering refinancing their mortgage to consolidate their current debts as they are having difficulties in paying the monthly payments.

They come to your office to get a financial advice.

Considering below information, what would be your suggestion?

Mortgage:

Current price of the property: EACH student should choose a value between $ Milion and $ Million dollars

Mortgage balance: of the current value

Prepayment privilege: EACH student can choose either or

Mortgage Amortization years

Interest rates are compounded semiannually, and payments are paid monthly.

Mortgage contract is fixed rate with months remaining, interest rate

Current market value

Extension interest rate

tableDebts:Balance,MonthlypaymentsLine of credit,$$

Mr and Mrs Goodwill are considering refinancing their mortgage to consolidate their current debts as they are having difficulties in paying the monthly payments.

They come to your office to get a financial advice.

Considering below information, what would be your suggestion?

Mortgage:

Current price of the property: EACH student should choose a value between $Milion and $ Million dollars

Mortgage balance: of the current value

Prepayment privilege: student can choose either or

Mortgage Amortization years

Interest rates are compounded semiannually, and payments are paid monthly.

Mortgage contract is fixed rate with months remaining, interest rate

Current market value

Extension interest rate

tableBalance,Debts:Monthly.payments$$

mes Pari

Mr and Mrs Goodwill are considering refinancing their mortgage to consolidate their current debts as they are having difficulties in paying the monthly payments.

They come to your office to get a financial advice.

Considering below information, what would be your suggestion?

Mortgage:

Current price of the property: EACH student should choose a value between $ Milion and $ Million dollars

Mortgage balance: of the current value

Prepayment privilege: EACH student can choose either or

Mortgage Amortization years

Interest rates are compounded semiannually, and payments are paid monthly.

Mortgage contract is fixed rate with months remaining, interest rate

Current market value

Extension interest rate

tableBalance,Debts:$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock