Question: Mr. JFK operates a convenience store while he offers bookkeeping services to his clients. In 2020. his gross sales amounted 10 P200,000 and additional income

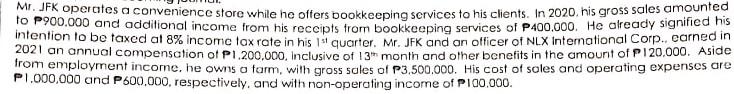

Mr. JFK operates a convenience store while he offers bookkeeping services to his clients. In 2020. his gross sales amounted 10 P200,000 and additional income from his receipts from bookkeeping services of P.400.000. He already signified his intention to be taxed al 8% income tax rate in his 1 quarter. Mr. JFK and an officer of NLX International Corp.carned in 2021 an annual compensation of P1.200.000, inclusive of 13month and other benefits in the amount of P120.000. Aside P1.000.000 and P600,000, respectively, and with non-operating income of P100,000. from employment income. he owns a farm, with gross sales of P3,500,000. His cost of sales and operating expenses are Mr. JFK operates a convenience store while he offers bookkeeping services to his clients. In 2020. his gross sales amounted 10 P200,000 and additional income from his receipts from bookkeeping services of P.400.000. He already signified his intention to be taxed al 8% income tax rate in his 1 quarter. Mr. JFK and an officer of NLX International Corp.carned in 2021 an annual compensation of P1.200.000, inclusive of 13month and other benefits in the amount of P120.000. Aside P1.000.000 and P600,000, respectively, and with non-operating income of P100,000. from employment income. he owns a farm, with gross sales of P3,500,000. His cost of sales and operating expenses are

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts