Question: Mr. Panini is the chief controller for Panini&Panini Corp (PPC), a Canadian company specializing in the production and distribution of fine Italian goods to

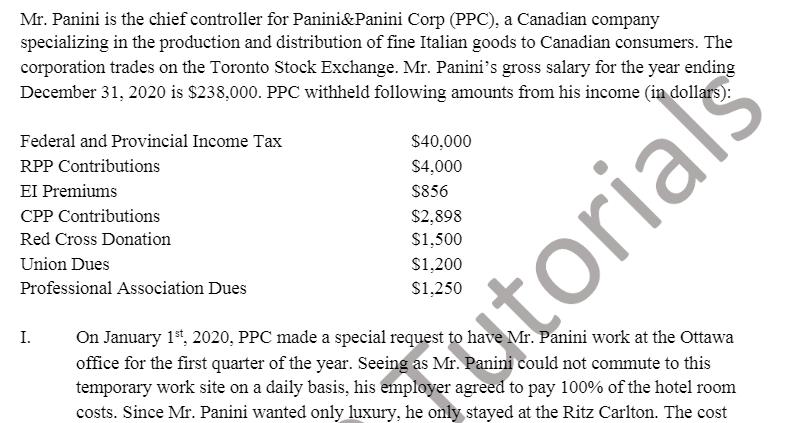

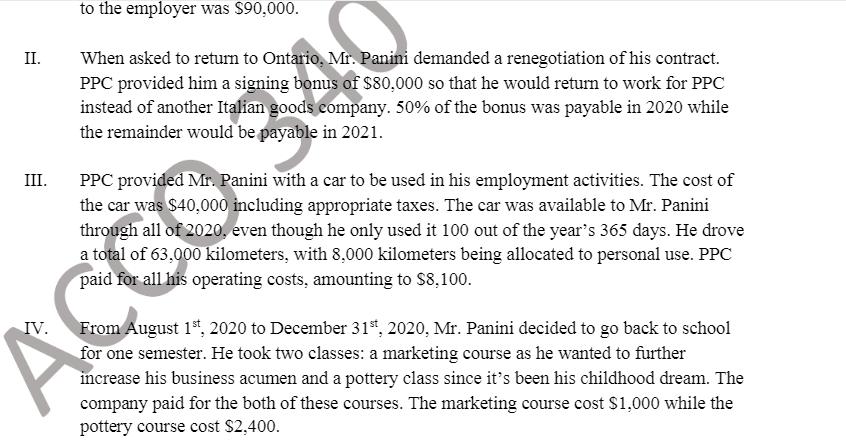

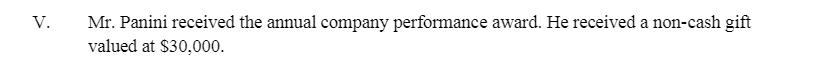

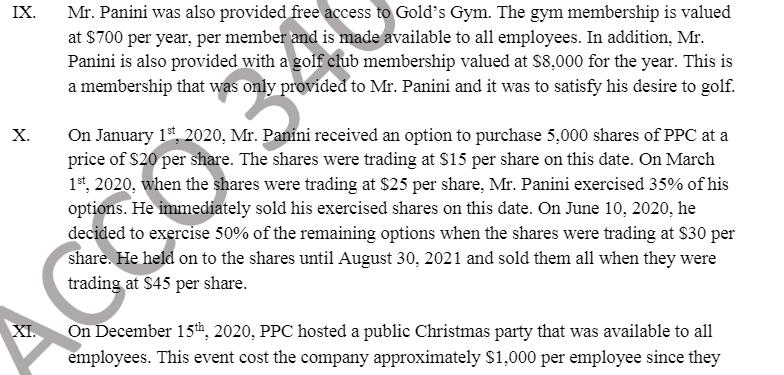

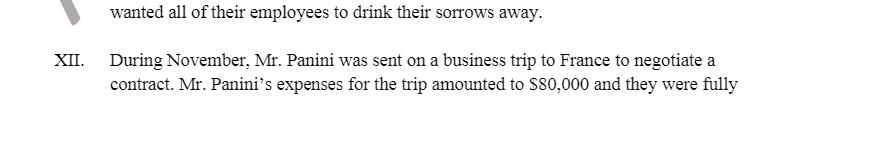

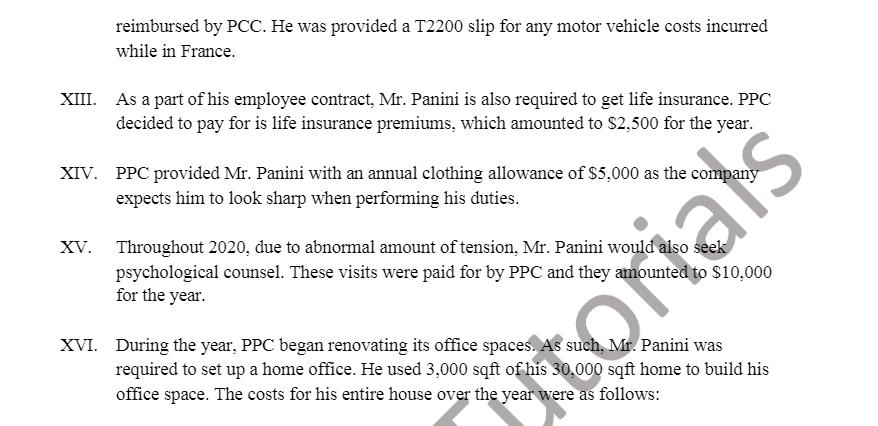

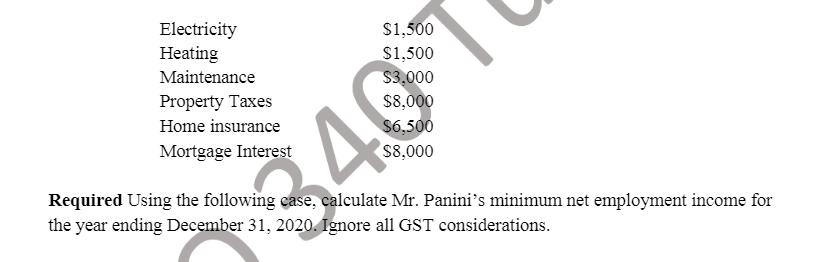

Mr. Panini is the chief controller for Panini&Panini Corp (PPC), a Canadian company specializing in the production and distribution of fine Italian goods to Canadian consumers. The corporation trades on the Toronto Stock Exchange. Mr. Panini's gross salary for the year ending December 31, 2020 is $238,000. PPC withheld following amounts from his income (in dollars): Federal and Provincial Income Tax $40,000 $4,000 RPP Contributions EI Premiums $856 CPP Contributions $2,898 $1,500 Red Cross Donation Union Dues $1,200 $1,250 Professional Association Dues I. On January 1st, 2020, PPC made a special request to have Mr. Panini work at the Ottawa office for the first quarter of the year. Seeing as Mr. Panini could not commute to this temporary work site on a daily basis, his employer agreed to pay 100% of the hotel room costs. Since Mr. Panini wanted only luxury, he only stayed at the Ritz Carlton. The cost torials to the employer was $90,000. II. When asked to return to Ontario, Mr. Panini demanded a renegotiation of his contract. PPC provided him a signing bonus of $80,000 so that he would return to work for PPC instead of another Italian goods company. 50% of the bonus was payable in 2020 while the remainder would be payable in 2021. III. PPC provided Mr. Panini with a car to be used in his employment activities. The cost of the car was $40,000 including appropriate taxes. The car was available to Mr. Panini through all of 2020, even though he only used it 100 out of the year's 365 days. He drove a total of 63,000 kilometers, with 8,000 kilometers being allocated to personal use. PPC paid for all his operating costs, amounting to $8,100. IV. From August 1st, 2020 to December 31st, 2020, Mr. Panini decided to go back to school for one semester. He took two classes: a marketing course as he wanted to further increase his business acumen and a pottery class since it's been his childhood dream. The company paid for the both of these courses. The marketing course cost $1,000 while the pottery course cost $2,400. V. Mr. Panini received the annual company performance award. He received a non-cash gift valued at $30,000. VI. When Mr. Panini returned to Toronto on April 1st, 2020, he immediately started searching for a new home, as he was tired of living in the downtown area. Mr. Panini found a house in the suburb and decided to move in at the start of the 3rd quarter. In order to assist him with this move, the employer provided Mr. Panini with a $400,000 interest-free loan. The CRA prescribed rates for the year were as follows: Quarter 1: 3% Quarter 3: 5% Quarter 4: 3% Quarter 2: 4% VII. In his employment related travels, Mr. Panini had accumulated over 100,000 Aeroplan points. During 2020, he used 50,000 of these points for a weekend flight to Los Angeles. The fair market value of the purchased tickets is approximately $1,000. VIII. During a hiking trip in August, Mr. Panini broke his leg trying to protect his dress shoes from getting dirty. In the aftermath, he was immediately hospitalized for 2 days and then forced to use a wheel chair till the end of August. PPC had paid into the company's group disability insurance on behalf of Mr. Panini. The premiums were $5,000. Mr. Panini received a disability benefit of $25,000. orials IX. Mr. Panini was also provided free access to Gold's Gym. The gym membership is valued at $700 per year, per member and is made available to all employees. In addition, Mr. Panini is also provided with a golf club membership valued at $8,000 for the year. This is a membership that was only provided to Mr. Panini and it was to satisfy his desire to golf. X. On January 1st, 2020, Mr. Panini received an option to purchase 5,000 shares of PPC at a price of $20 per share. The shares were trading at $15 per share on this date. On March 1st, 2020, when the shares were trading at $25 per share, Mr. Panini exercised 35% of his options. He immediately sold his exercised shares on this date. On June 10, 2020, he decided to exercise 50% of the remaining options when the shares were trading at $30 per share. He held on to the shares until August 30, 2021 and sold them all when they were trading at $45 per share. XI. On December 15th, 2020, PPC hosted a public Christmas party that was available to all employees. This event cost the company approximately $1,000 per employee since they wanted all of their employees to drink their sorrows away. XII. During November, Mr. Panini was sent on a business trip to France to negotiate a contract. Mr. Panini's expenses for the trip amounted to $80,000 and they were fully reimbursed by PCC. He was provided a T2200 slip for any motor vehicle costs incurred while in France. XIII. As a part of his employee contract, Mr. Panini is also required to get life insurance. PPC decided to pay for is life insurance premiums, which amounted to $2,500 for the year. XIV. PPC provided Mr. Panini with an annual clothing allowance of $5,000 as the company expects him to look sharp when performing his duties. XV. Throughout 2020, due to abnormal amount of tension, Mr. Panini would also seek psychological counsel. These visits were paid for by PPC and they amounted to $10,000 for the year. XVI. During the year, PPC began renovating its office spaces. As such, Mr. Panini was required to set up a home office. He used 3,000 sqft of his 30,000 sqft home to build his office space. The costs for his entire house over the year were as follows: Tonals $1,500 $1,500 Electricity Heating Maintenance Property Taxes $3,000 $8,000 Home insurance $6,500 Mortgage Interest $8,000 Required Using the following case, calculate Mr. Panini's minimum net employment income for the year ending December 31, 2020. Ignore all GST considerations.

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Mr Paninis minimum net employment income for the year ending December ... View full answer

Get step-by-step solutions from verified subject matter experts