Question: Mr. Stark is a programmer. On March 26., 2022, Mr. Stark accepted an assignment in data mining from a research center. The price of

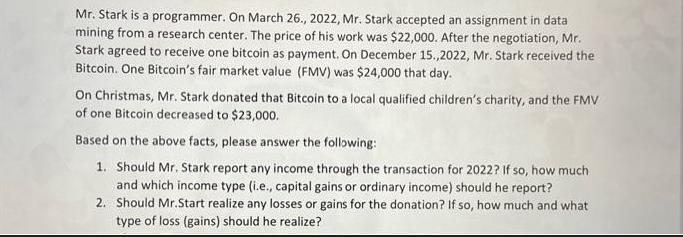

Mr. Stark is a programmer. On March 26., 2022, Mr. Stark accepted an assignment in data mining from a research center. The price of his work was $22,000. After the negotiation, Mr. Stark agreed to receive one bitcoin as payment. On December 15.,2022, Mr. Stark received the Bitcoin. One Bitcoin's fair market value (FMV) was $24,000 that day. On Christmas, Mr. Stark donated that Bitcoin to a local qualified children's charity, and the FMV of one Bitcoin decreased to $23,000. Based on the above facts, please answer the following: 1. Should Mr. Stark report any income through the transaction for 2022? If so, how much and which income type (i.e., capital gains or ordinary income) should he report? 2. Should Mr.Start realize any losses or gains for the donation? If so, how much and what type of loss (gains) should he realize?

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

1 Yes Mr Stark should report income from the transaction in 2022 The income type will depend on whet... View full answer

Get step-by-step solutions from verified subject matter experts