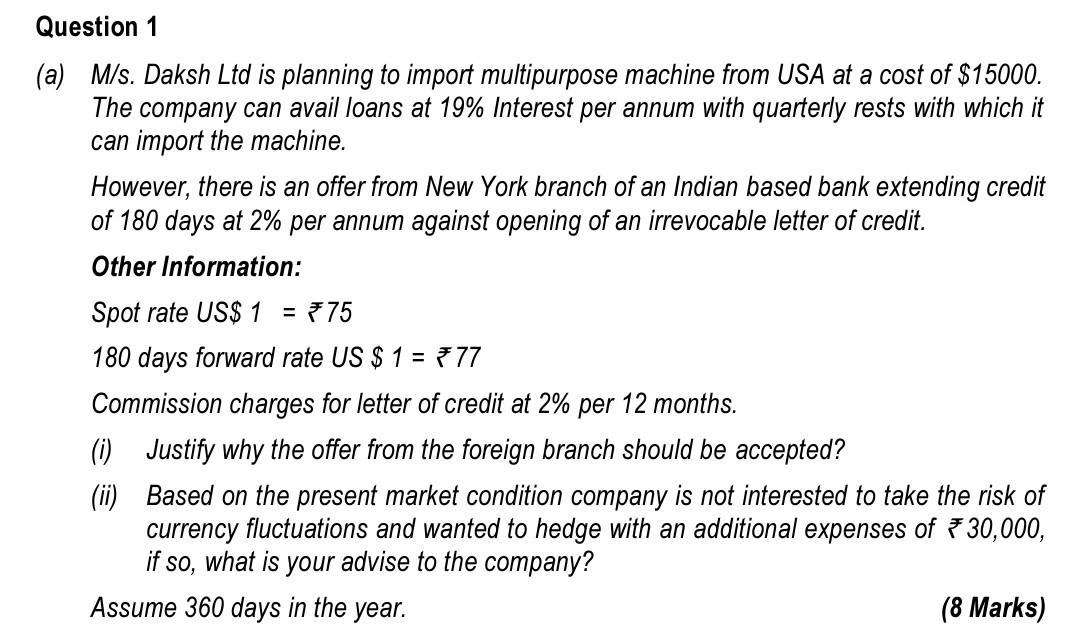

Question: M/s. Daksh Ltd is planning to import multipurpose machine from USA at a cost of $15000. The company can avail loans at 19% Interest per

M/s. Daksh Ltd is planning to import multipurpose machine from USA at a cost of $15000. The company can avail loans at 19% Interest per annum with quarterly rests with which it can import the machine. However, there is an offer from New York branch of an Indian based bank extending credit of 180 days at 2% per annum against opening of an irrevocable letter of credit. Other Information: Spot rate US\$1 =75 180 days forward rate US $1=77 Commission charges for letter of credit at 2% per 12 months. (i) Justify why the offer from the foreign branch should be accepted? (ii) Based on the present market condition company is not interested to take the risk of currency fluctuations and wanted to hedge with an additional expenses of 30,000, if so, what is your advise to the company? Assume 360 days in the year. (8 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts