Question: please answer and show work using the excel format privided for each requirements Liars Wallace is general manager of Moonwalk Salons During 2018, Wallace worked

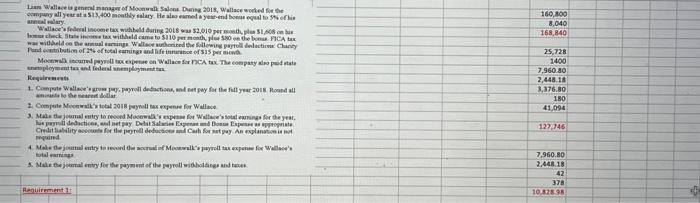

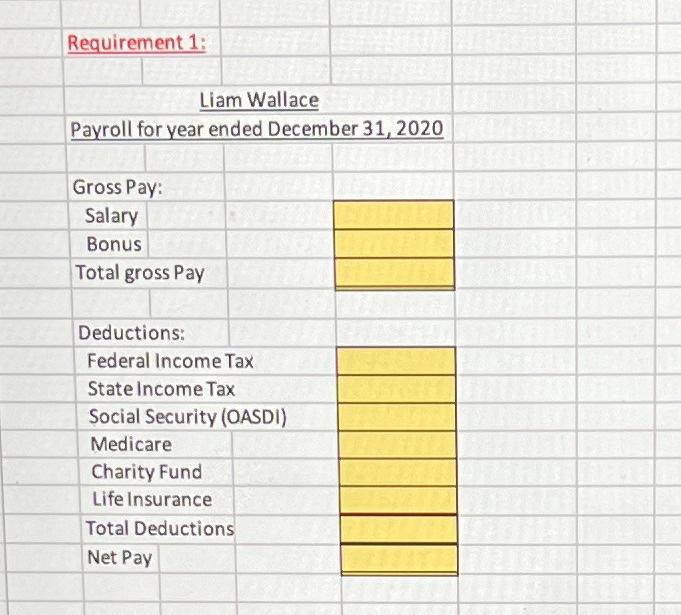

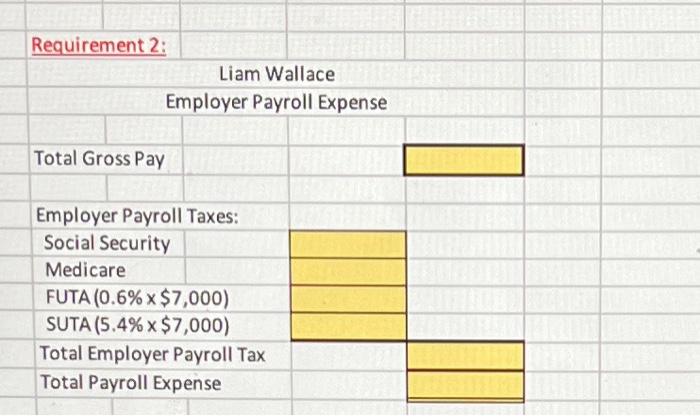

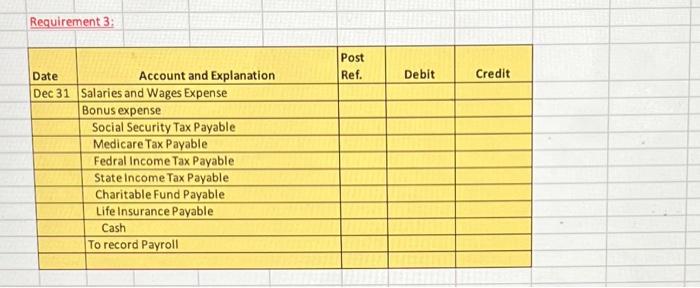

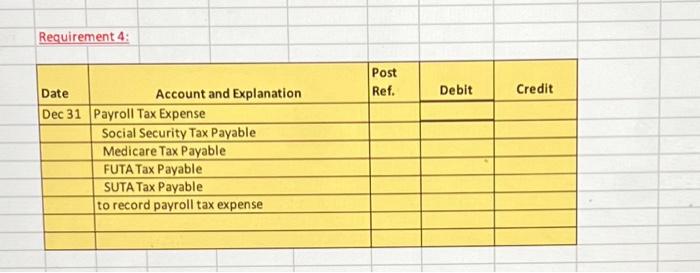

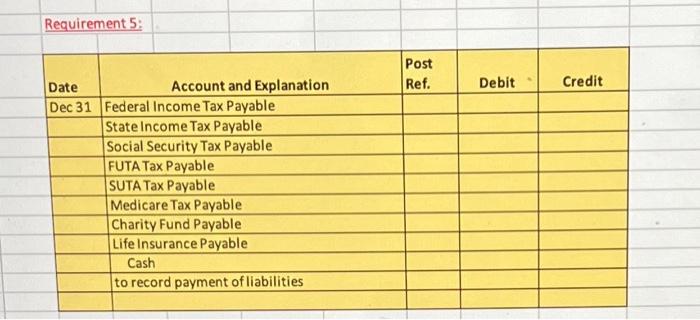

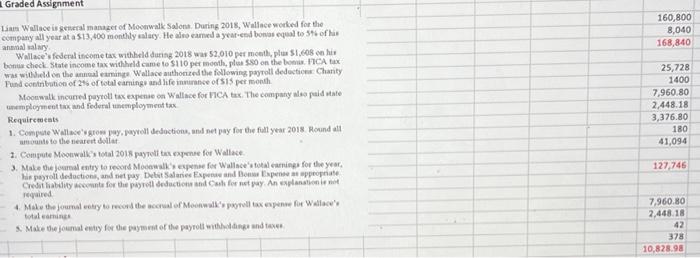

Liars Wallace is general manager of Moonwalk Salons During 2018, Wallace worked for the company all year at a $13,400 monthly salary. He also earned a year-end bonus equal to 5% of his anlary. Wallace's federal income tax withheld during 2018 was 52,010 per month, plea $1,606 bi hose check State income tax withheld came to $110 per month, plus $80 on the boma FICA tax was withheld on the annual earnings Wallace authorized the following payroll dedaction Chanty Pand contribution of 2% of total earnings and life insurance of $15 per month Moonwalk incurred payroll tax expense on Wallace for FICA tax. The company also paid state nemployment tax and federal snemployment tax Requirements 1. Compute Wallace's grow pay, payroll dedactions, and net pay for the full year 2018. Round all amants to the nearest dollar 1. Compute Moonwalk's total 2018 payroll tax expense for Wallace 3. Mala the journal entry to recoed Moonwalk's expense for Wallace's total earnings for the year. his payroll dedictions, and net pay Delst Salaries Expense and Bone Expense as appropriate Credit liability accounts for the peyroll deductions and Cash for net pay. An explanation is not required 4. Make the journal entry to record the accrual of Moonwalk's payroll tax expense for Wallace's totalnings 5. Make the journal entry for the payment of the payroll withholdings and t Requirement 1 160,800 8,040 168,840 25,728 1400 7,960.80 2,448.18 3,376.80 180 41,094 127,746 7,960.80 2,448.18 42 378 10.828.98 Requirement 1: Liam Wallace Payroll for year ended December 31, 2020 Gross Pay: Salary Bonus Total gross Pay Deductions: Federal Income Tax State Income Tax Social Security (OASDI) Medicare Charity Fund Life Insurance Total Deductions Net Pay FALSTER Requirement 2: Total Gross Pay Employer Payroll Taxes: Social Security Medicare FUTA (0.6% x $7,000) SUTA (5.4% x $7,000) Total Employer Payroll Tax Total Payroll Expense Liam Wallace Employer Payroll Expense Requirement 3: Date Dec 31 Salaries and Wages Expense Bonus expense Social Security Tax Payable Medicare Tax Payable Fedral Income Tax Payable State Income Tax Payable Charitable Fund Payable Life Insurance Payable Cash To record Payroll Account and Explanation Post Ref. Debit Credit Requirement 4: Date Dec 31 Payroll Tax Expense Account and Explanation Social Security Tax Payable Medicare Tax Payable FUTA Tax Payable SUTA Tax Payable to record payroll tax expense Post Ref. Debit Credit Requirement 5: Date Dec 31 Federal Income Tax Payable State Income Tax Payable Social Security Tax Payable FUTA Tax Payable SUTA Tax Payable Medicare Tax Payable Charity Fund Payable Life Insurance Payable Cash to record payment of liabilities Account and Explanation Post Ref. Debit Credit Graded Assignment Liam Wallace is general manager of Moonwalk Salona. During 2018, Wallace worked for the company all year at a $13,400 monthly salary. He also earned a year-end bonas equal to 5% of his annmal salary. Wallace's federal income tax withheld during 2018 was $2,010 per month, plus $1,608 on his bonus check. State income tax withheld came to $110 per month, plus 580 on the box FICA tax was withheld on the annual eaminge Wallace authorized the following payroll deductions Charity Fund contribution of 2% of total earnings and life insurance of $15 per month Moonwalk incurred payroll tax expense on Wallace for FICA tax. The company also paid state unemployment tax and federal unemployment tax Requirements 1. Compute Wallace's gross pay, payroll deductions, and net pay for the full year 2018. Round all amounts to the nearest dollar. 1. Compute Moonwalk's total 2018 payroll tax expense for Wallace. 3. Make the journal entry to record Moonwalk's expense for Wallace's total earnings for the year, his payroll deductions, and net pay Debit Salaries Expense and Bonus Expense as appropriate Credit liability accounts for the payroll deductions and Cash for net pay. An explanation is not required 4. Make the journal entry to record the accrual of Moonwalk's payroll tax expense for Wallace's total earings S. Make the journal entry for the payment of the payroll withholdings and taxes 160,800 8,040 168,840 25,728 1400 7,960.80 2,448.18 3,376.80 180 41,094 127,746 7,960.80 2,448.18 42 378 10,828.98

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts