Question: MTH 1 1 5 - GENERAL EDUCATION MATHEMATICS PROJECT - CHAPTER 1 0 PROJECT # 1 ( Ch 1 0 - Mortgages ) Name Date:

MTH GENERAL EDUCATION MATHEMATICS

PROJECT CHAPTER

PROJECT #Ch Mortgages

Name

Date:

Score

The Smiths are purchasing their first home. They are a twoperson household with pets but no

children. They fell in love with a house that is listed at $ and want to make an offer.

Before they do they want to consider the financial responsibilities of owning a house.

Part : Down Payment and Mortgage

They are planning to make a down payment. points

a Determine the amount of the down payment.

b Determine the amount of the mortgage after they make the down payment.

Part : A Year vs a Year Fixed mortgage

The Smiths really want to pay off their house as fast as possible, and are interested in a

year fixed mortgage at an interest rate of Determine the monthly payment for

principal and interest after they make the down payment. points

The Smiths realize the year mortgage may be out of their budget, and are also willing

to consider a year fixed mortgage at a slightly higher interest rate of

Determine the monthly payment for principal and interest after they make the down

payment. points

MTH GENERAL EDUCATION MATHEMATICS

PROJECT CHAPTER

Part : More about the Year Fixed mortgage

They have a combined income of $ per year, which means that their combined

posttax gross takehome pay is approximately $ per month. Their car is paid off

and they do not currently have any other fixed monthly payments to consider.

Determine of the Smiths adjusted monthly income. Remember, this is the

maximum they can afford. points

Part : Other Financial Considerations

The Smiths have been researching strategies for a monthly budget. They have decided

to use the simple budget framework they found on

nerdwallet.com. of

their budget is supposed to go to needs, is for wants, and is for a combination

of savings and debt repayment. Remember, their posttax monthly income is $

points

a Needs: What is of their monthly income?

b Wants: What is of their monthly income?

c SavingsDebt Repayment: What is of their monthly income?

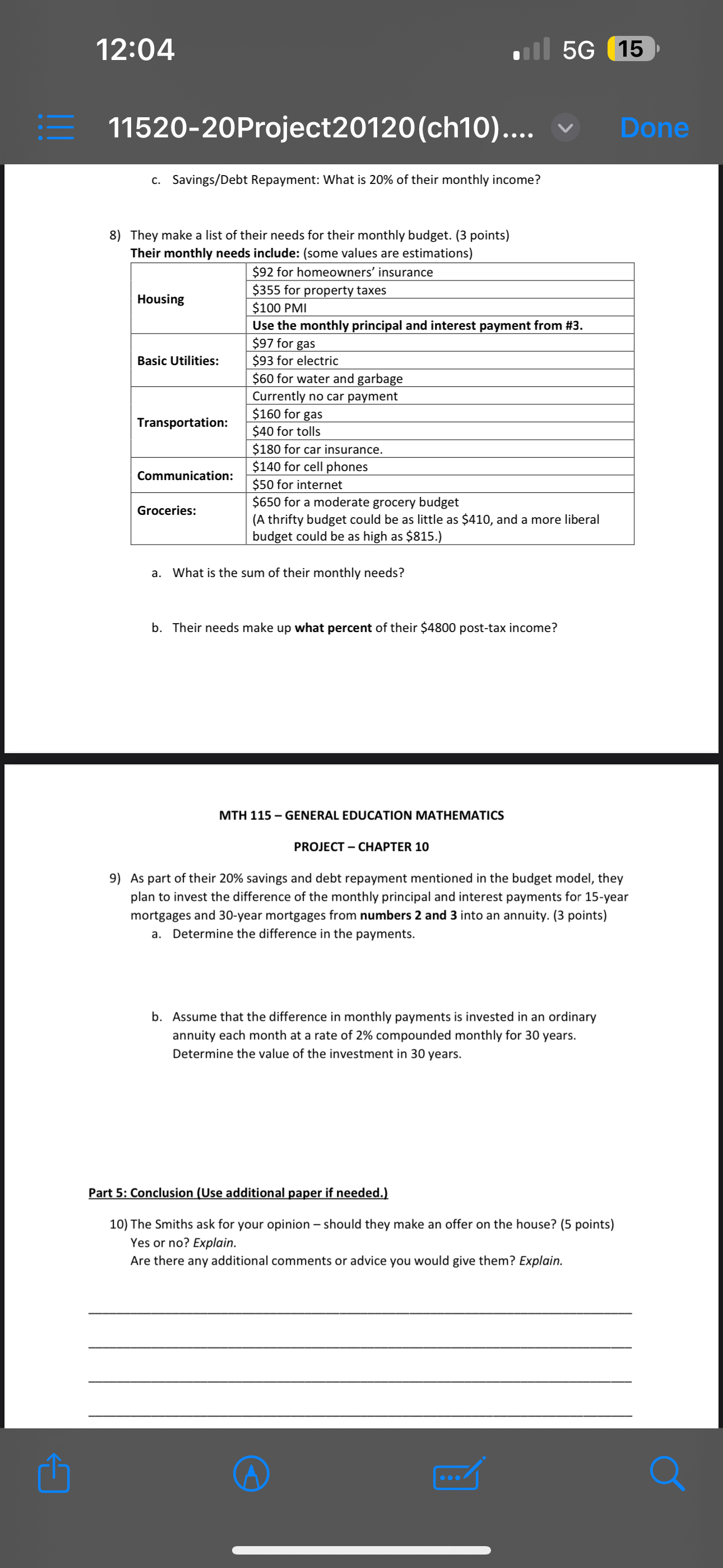

They make a list of their needs for their monthly budget. points

Their monthly needs include: some values are estimations

a What is the sum of their monthly needs?

b Their needs make up what percent of their $ posttax income?

MTH GENERAL EDUCATION MATHEMATICS

PROJECT CHAPTER

As part of their savings and debt repayment mentioned in the budget model, they

plan to invest the difference of the monthly principal and interest payments for year

mortgages and year mortgages from numbers and into an annuity. points

a Determine the difference in the payments.

b Assume that the difference in monthly payments is invested in an ordinary

annuity each month at a rate of compounded monthly for years.

Determine the value of the investment in years.

Part : Conclusion Use additional paper if needed.

The Smiths ask for your opinion should they make an offer on the house? points

Yes or no Explain.

Are there any additional comments or advice you would give them? Explain.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock