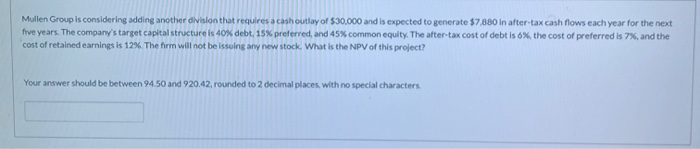

Question: Mullen Group is considering adding another division that requires a cash outlay of $30,000 and is expected to generate $7,880 in after tax cash flows

Mullen Group is considering adding another division that requires a cash outlay of $30,000 and is expected to generate $7,880 in after tax cash flows each year for the next five years. The company's target capital structure is 40% debt 15% preferred, and 45% common equity. The after-tax cost of debt is 6%, the cost of preferred is 7%, and the cost of retained earnings is 12%. The firm will not be issuing any new stock. What is the NPV of this project? Your answer should be between 94.50 and 920 42, rounded to 2 decimal places, with no special characters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts