Question: Multiple Attempts Not allowed. This test can only be taken once. Force Completion This test can be saved and resumed at any point until time

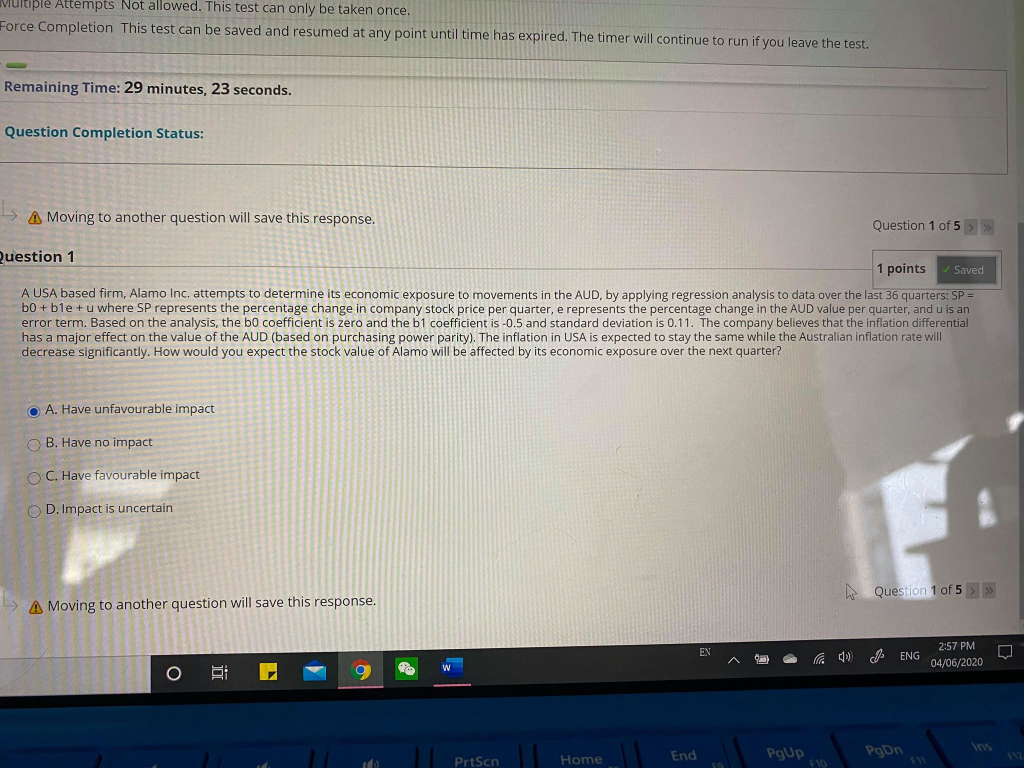

Multiple Attempts Not allowed. This test can only be taken once. Force Completion This test can be saved and resumed at any point until time has expired. The timer will continue to run if you leave the test. Remaining Time: 29 minutes, 23 seconds. Question Completion Status: >> A Moving to another question will save this response. Question 1 of 5 > >> Question 1 1 points Saved A USA based firm, Alamo Inc. attempts to determine its economic exposure to movements in the AUD, by applying regression analysis to data over the last 36 quarters: SP = b0+b1e+u where SP represents the percentage change in company stock price per quarter, e represents the percentage change in the AUD value per quarter, and u is an error term. Based on the analysis, the bo coefficient is zero and the b1 coefficient is -0.5 and standard deviation is 0.11. The company believes that the inflation differential has a major effect on the value of the AUD (based on purchasing power parity). The inflation in USA is expected to stay the same while the Australian inflation rate will decrease significantly. How would you expect the stock value of Alamo will be affected by its economic exposure over the next quarter? A. Have unfavourable impact B. Have no impact C. Have favourable impact OD. Impact is uncertain Question 1 of 5 > >> A Moving to another question will save this response. EN 2:57 PM 04/06/2020 n A ENG O PrtScn End Home Pgon Pgup Multiple Attempts Not allowed. This test can only be taken once. Force Completion This test can be saved and resumed at any point until time has expired. The timer will continue to run if you leave the test. Remaining Time: 29 minutes, 23 seconds. Question Completion Status: >> A Moving to another question will save this response. Question 1 of 5 > >> Question 1 1 points Saved A USA based firm, Alamo Inc. attempts to determine its economic exposure to movements in the AUD, by applying regression analysis to data over the last 36 quarters: SP = b0+b1e+u where SP represents the percentage change in company stock price per quarter, e represents the percentage change in the AUD value per quarter, and u is an error term. Based on the analysis, the bo coefficient is zero and the b1 coefficient is -0.5 and standard deviation is 0.11. The company believes that the inflation differential has a major effect on the value of the AUD (based on purchasing power parity). The inflation in USA is expected to stay the same while the Australian inflation rate will decrease significantly. How would you expect the stock value of Alamo will be affected by its economic exposure over the next quarter? A. Have unfavourable impact B. Have no impact C. Have favourable impact OD. Impact is uncertain Question 1 of 5 > >> A Moving to another question will save this response. EN 2:57 PM 04/06/2020 n A ENG O PrtScn End Home Pgon Pgup

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts