Question: Multiple Choice 1 - 1 7 Filing Status and Tax Computation ( LO 1 . 5 ) Joan, who was divorced in 2 0 2

Multiple Choice

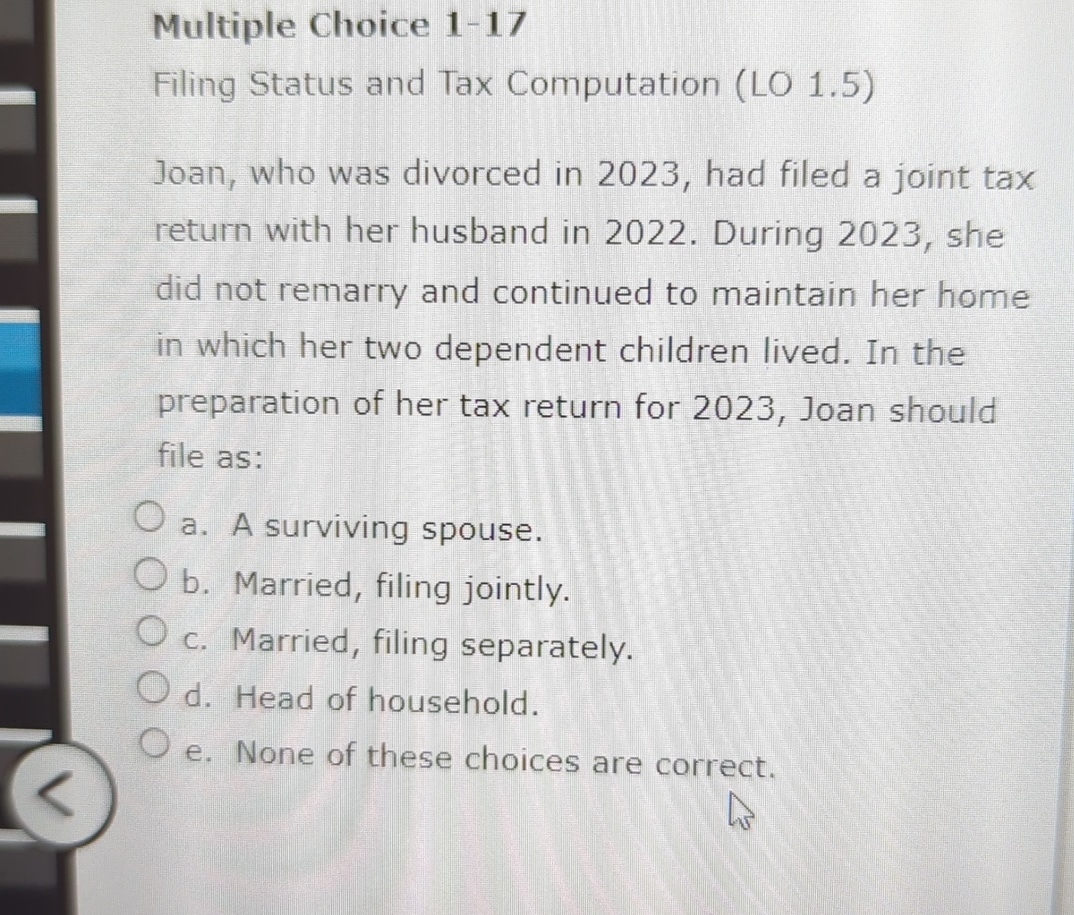

Filing Status and Tax Computation LO

Joan, who was divorced in had filed a joint tax return with her husband in During she did not remarry and continued to maintain her home in which her two dependent children lived. In the preparation of her tax return for Joan should file as:

a A surviving spouse.

b Married, filing jointly.

c Married, filing separately.

d Head of household.

e None of these choices are correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock