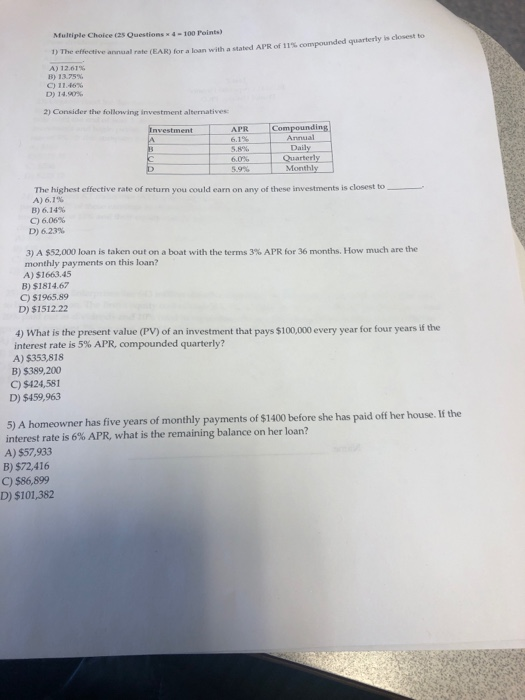

Question: Multiple Choice (25 OQuestions 4 -100 Points) 1) The effective annual rate (EAR) for a loan with a stated APR of 11% compounded quarterly-cosest to

Multiple Choice (25 OQuestions 4 -100 Points) 1) The effective annual rate (EAR) for a loan with a stated APR of 11% compounded quarterly-cosest to A) 12.61% B) 13.75% C)11.46% D) 14.90% 2) Consider the following investment alternativess APR 6.1% 5.8% 6.0% Compounding Annual Daily arterly Monthly The highest effective rate of return you could earn on any of these investments is closest to A) 6.1% B) 6.14% C) 6.06% D) 623% 3) A S52000 loan is taken out on a boat with the terms 3% APR for 36 months. How much are the monthly payments on this loani? A) $1663.45 B) $1814.67 C)$1965.89 D) $1512.22 4) What is the present value (PV) of an investment that pays $100,000 every year for four years if the interest rate is 5% APR, compounded quarterly? A) $353818 B) $389,200 C) $424,581 D) $459,963 5) A homeowner has five years of monthly payments of $1400 before she has paid off her house. If the interest rate is 6% APR, what is the remaining balance on her loan? A) $57,933 B) $72,416 C) $86,899 D) $101,382

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts