Question: Need help with some question. 1) Drew receives an inheritance that pays him 45,000 every three months for the next two. Which of the following

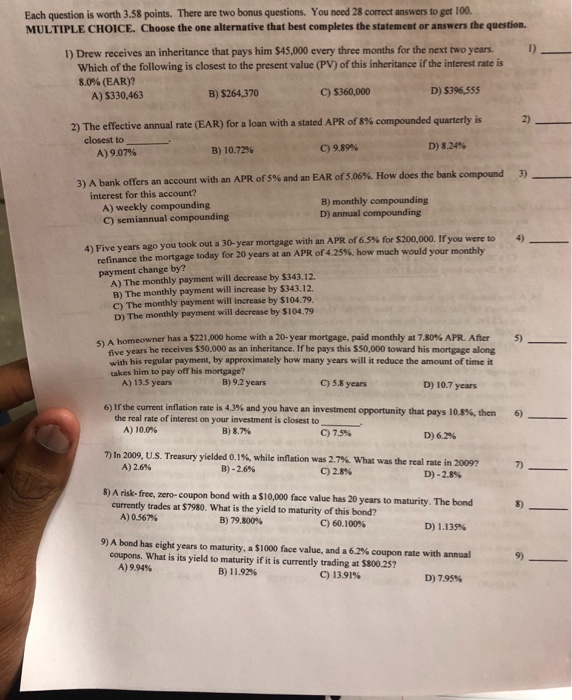

Each question is worth 3.58 points. There are two bonus questions. You need 28 correct answers to get 100 MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) 1) Drew receives an inheritance that pays him $45,000 every three months for the next two years Which of the following is closest to the present value (PV) of this inheritance if the interest rate is 80% (EAR)? A) S330,463 B) $264,370 C) $360,000 D) $396,555 2) 2) The effective annual rate (EAR) for a loan with a stated APR of 8% compounded quarterly is closest to B) 10.72% C)9.89% D) 8.24% A) 90796 3) A bank offers an account with an APR of 5% and an EAR of 5.06%. How does the bank compound interest for this account? A) weekly compounding C) semiannual compounding B) monthly compounding D) annual compounding 4) 4) Five years ago you took out a 30-year mortgage with an APR of6.5% for S200.000. tryou were to refinance the mortgage today for 20 years at an APR of 4.25%, how much would payment change by? your monthly A) The monthly payment will decrease by $343.12. B) The monthly payment will increase by $343.12. C) The monthly payment will increase by $104.79. D) The monthly payment will decrease by $104.79 5) A homeowner has a S22 1,000 home with a 20-year mortgage, paid monthly at 7.80% APR. After five years he receives $50,000 as an inheritance. If he pays this $$0,000 toward his mortgage along with his regular payment, by approximately how many years will it reduce the amount of time it takes him to pay off his mortgage? 5) A) 13.3 years B) 9.2 years C) 5.8 yeans D) 10.7 years 6)If the current inflation rate is 4.3% and you have an investment opportunity that pays i 0 5%, then 6) the real rate of interest on your investment is closest to -- A) 10.0% B) 8.7% C) 7.9% D) 62% 7) In 2009, U.S. Treasury yielded 0.1%, while inflation was 2.7%. what was the real ate in 2009? 7) A) 2.6% B)-2.6% C)2.8% D)-2.8% 8) A risk- free, zero-coupon bond with a $10,000 face value has 20 years to maturity. The bond 8) currently trades at $7980. What is the yield to maturity of this bond? B)79.300% A) 0.567% C)60.100% D) 1.135% 9)Abond has eight years to maturity, a $1000 face value, and a 62% coupon rate with annual coupons. What is its yield to maturity if it is currently trading at $800.25 9) A) 9.94% B) 11.92% C) 13.91% D) 795%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts