Question: multiple choice acc B b. c. d. 2 b. C. d. 22. Under the direct write-off method of accounting for Uncollectible accounts, Bad Debts Expense

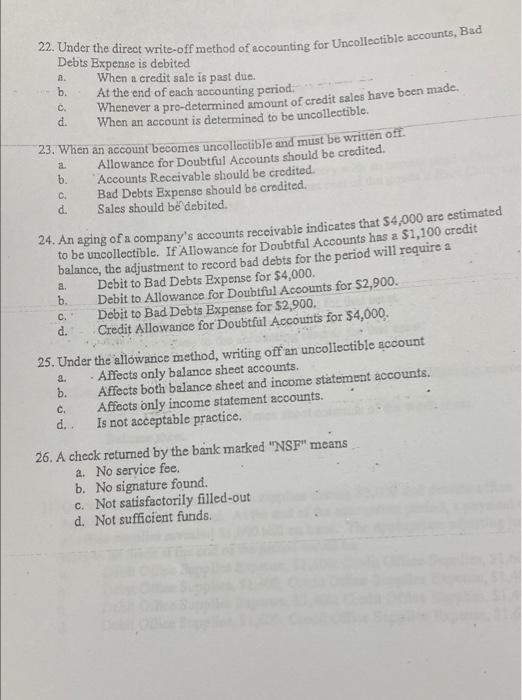

B b. c. d. 2 b. C. d. 22. Under the direct write-off method of accounting for Uncollectible accounts, Bad Debts Expense is debited When a credit sale is past due. At the end of each accounting period. Whenever a pro-determined amount of credit sales have been made. When an account is determined to be uncollectible. 23. When an account becomes uncollectible and must be written ofl. Allowance for Doubtful Accounts should be credited. Accounts Receivable should be credited. Bad Debts Expense should be credited. Sales should be debited. 24. An aging of a company's accounts receivable indicates that $4,000 are estimated to be uncollectible. If Allowance for Doubtful Accounts has a $1,100 credit balance, the adjustment to record bad debts for the period will require a Debit to Bad Debts Expense for $4,000. Debit to Allowance for Doubtful Accounts for $2,900. Debit to Bad Debts Expense for $2,900. Credit Allowance for Doubtful Accounts for $4,000. 25. Under the allowance method, writing off an uncollectible account Affects only balance sheet accounts. b. Affects both balance sheet and income statement accounts. Affects only income statement accounts. d. Is not acceptable practice. 26. A check retumed by the bank marked "NSF" means a. No service fee. b. No signature found. c. Not satisfactorily filled-out d. Not sufficient funds. a. b. C. d. a. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts