Question: Multiple choice choose the correct selction. The distinction between main products and byproducts is largely influenced by: Federal income tax regulations The relative number of

Multiple choice choose the correct selction.

Multiple choice choose the correct selction.

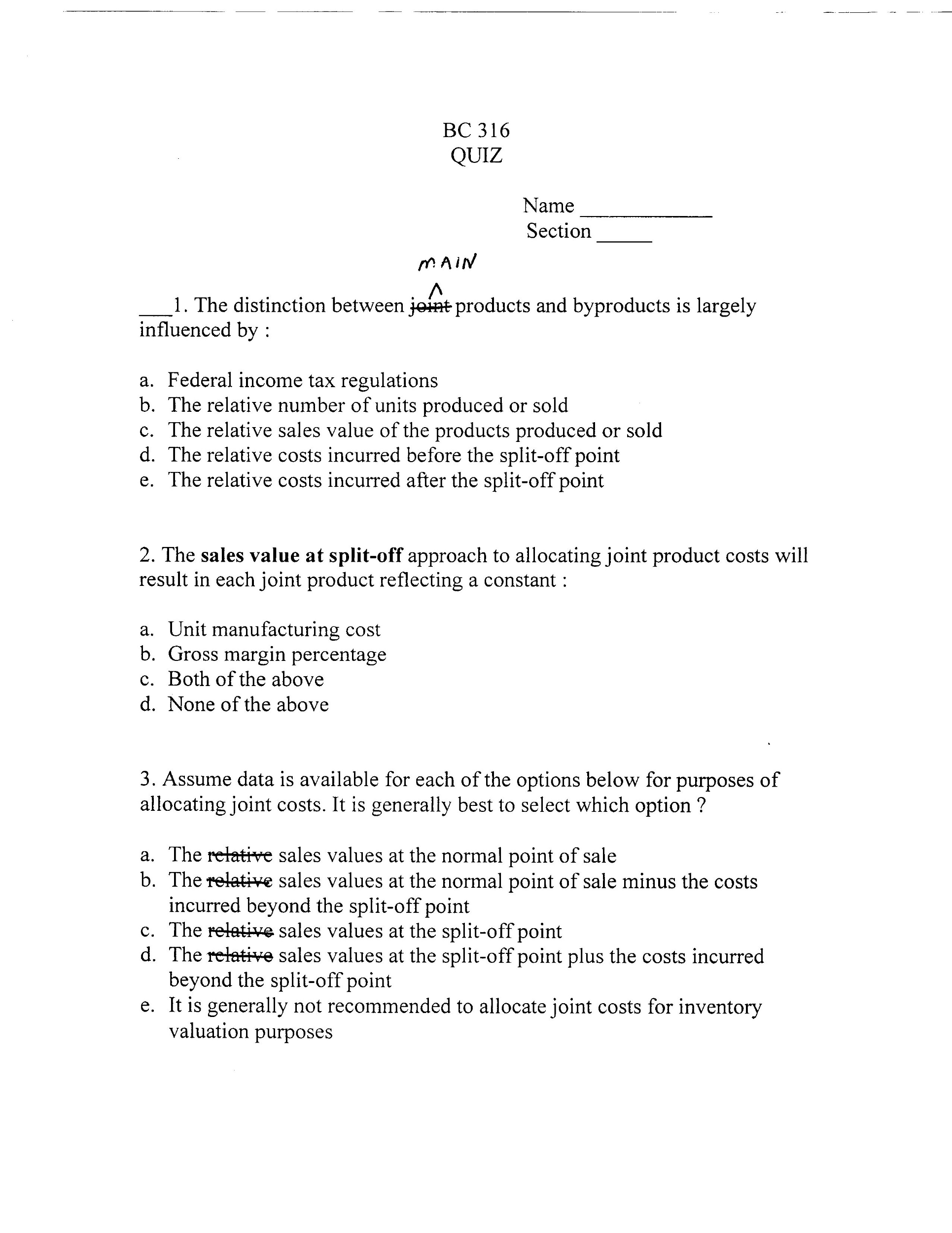

The distinction between main products and byproducts is largely influenced by: Federal income tax regulations The relative number of units produced or sold The relative sales value of the products produced or sold The relative costs incurred before the split-off point The relative costs incurred after the split-off point 2. The sales value at split-off approach to allocating joint product costs will result in each joint product reflecting a constant: a. Unit manufacturing cost b. Gross margin percentage C. Both of the above d. None of the above 3 . Assume data is available for each of the options below for purposes of allocating joint costs. It is generally best to select which option? a. The relative sales values at the normal point of sale b. The relative sales values at the normal point of sale minus the costs incurred beyond the split -off point c. The relative sales values at the split -off point d. The relative sales values at the split -off point plus the costs incurred beyond the split -off point e. It is generally not recommended to allocate joint costs for inventory valuation purposes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts