Question: MULTIPLE CHOICE. Choose the one alternative that BEST completes the statement or answers the question. ( 4 points each) 1. Baruch Company is expected to

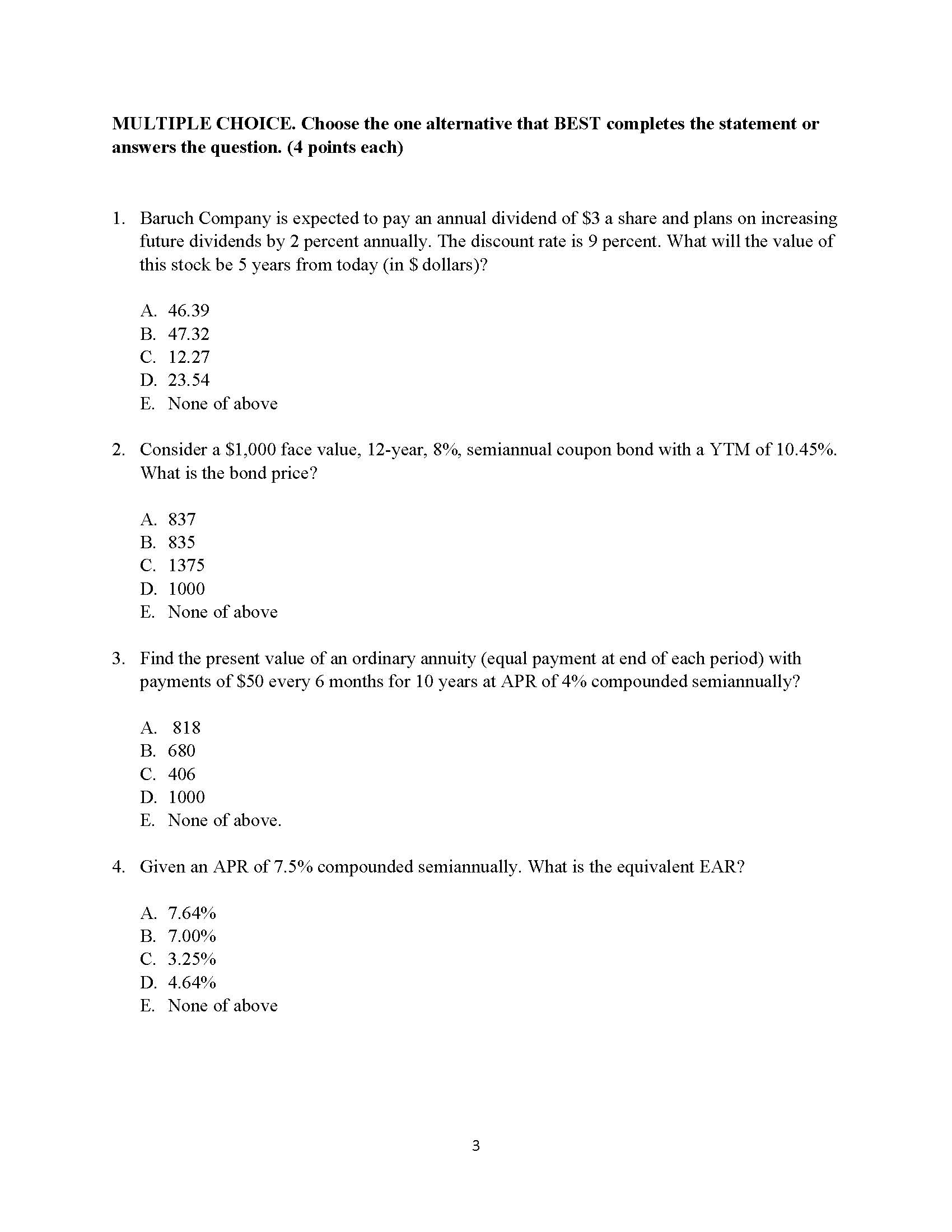

MULTIPLE CHOICE. Choose the one alternative that BEST completes the statement or answers the question. ( 4 points each) 1. Baruch Company is expected to pay an annual dividend of $3 a share and plans on increasing future dividends by 2 percent annually. The discount rate is 9 percent. What will the value of this stock be 5 years from today (in \$ dollars)? A. 46.39 B. 47.32 C. 12.27 D. 23.54 E. None of above 2. Consider a $1,000 face value, 12 -year, 8%, semiannual coupon bond with a YTM of 10.45%. What is the bond price? A. 837 B. 835 C. 1375 D. 1000 E. None of above 3. Find the present value of an ordinary annuity (equal payment at end of each period) with payments of $50 every 6 months for 10 years at APR of 4% compounded semiannually? A. 818 B. 680 C. 406 D. 1000 E. None of above. 4. Given an APR of 7.5% compounded semiannually. What is the equivalent EAR? A. 7.64% B. 7.00% C. 3.25% D. 4.64% E. None of above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts