Question: MULTIPLE CHOICE PRUDLEMS A sample of multiple choice pr riple choice problems is provided below. Additional multiple choice problems repailable at money-education.com by accessing the

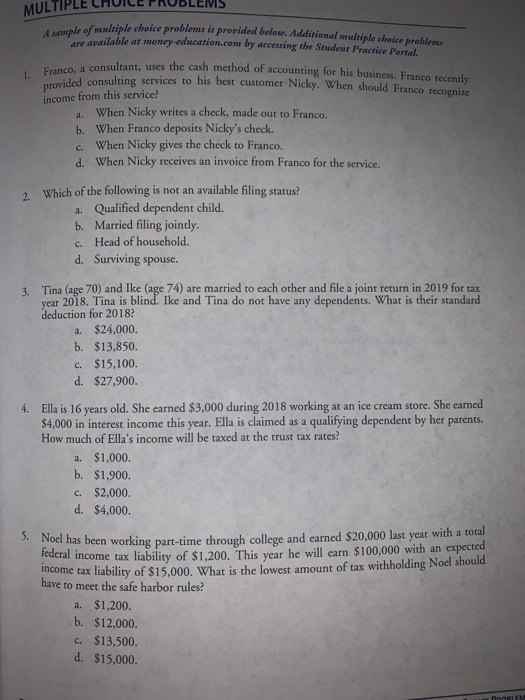

MULTIPLE CHOICE PRUDLEMS A sample of multiple choice pr riple choice problems is provided below. Additional multiple choice problems repailable at money-education.com by accessing the Student Practice Partal 1. Franco, a consultant provided consulri consultant, uses the cash method of accounting for his business. Franco recently ed consulting services to his best customer Nicky. When should Franco recognize income from this service? a When Nicky writes a check, made out to Franco. b. When Franco deposits Nicky's check. c. When Nicky gives the check to Franco. d. When Nicky receives an invoice from Franco for the service. 2. Which of the following is not an available filing status? a. Qualified dependent child. b. Married filing jointly. c. Head of household d. Surviving spouse. 3 Tina (age 70) and Ike (age 74) are married to each other and file a joint return in 2019 for tax year 2018. Tina is blind. Ike and Tina do not have any dependents. What is their standard deduction for 2018 a. $24,000. b. $13,850. c. $15,100. d. $27,900. 4. Ella is 16 years old. She earned $3,000 during 2018 working at an ice cream store. She earned $4,000 in interest income this year. Ella is claimed as a qualifying dependent by her parents. How much of Ella's income will be taxed at the trust tax rates? a. $1,000 b. $1,900 c. $2,000. d. $4,000. el has been working part-time through college and earned $20,000 last year with a total deral income tax liability of $1,200. This year he will earn $100,000 with an expected me tax liability of $15,000. What is the lowest amount of tax withholding Noel should have to meet the safe harbor rules? a. $1,200. b. $12,000. c. $13,500. d. $15.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts