Question: MULTIPLE CHOICE. question. Choose the one alternative that best completes the statement or answers the 1) What is the standard deviation of a portfolio's returns

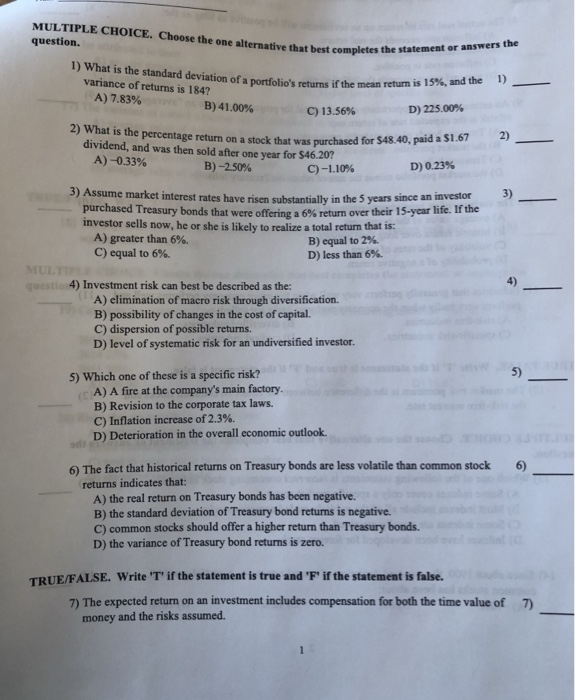

MULTIPLE CHOICE. question. Choose the one alternative that best completes the statement or answers the 1) What is the standard deviation of a portfolio's returns variance of returns is 184? 1) if the mean return is 15%, and the A) 7.83% B)41.00% C) 13.56% D) 225.00% is the percentage return on a stock that was purchased for $48.40, paid a $1.672 A)-0.33% dividend, and was then sold after one year for $46.20? B)-250% C)-1.10% D) 0.23% 3) Assume market interest rates have risen substantially in the 5 years purchased Treasury bonds that were offering a 6% return over since an investor 3) their 15-year life.fthe investor sells now, he or she is likely to realize a total return that is: A) greater than 6%. C) equal to 6%. B)equal to 2% D)less than 6%. 4) Investment risk can best be described as the: 4) A) elimination of macro risk through diversification. B) possibility of changes in the cost of capital. C) dispersion of possible returns. D) level of systematic risk for an undiversified investor. 5) 5) Which one of these is a specific risk? A) A fire at the company's main factory. B) Revision to the corporate tax laws. C) Inflation increase of 2.3%. D) Deterioration in the overall economic outlook 6) The fact that historical returns on Treasury bonds are less volatile than common stock 6) returns indicates that: A) the real return on Treasury bonds has been negative. B) the standard deviation of Treasury bond returns is negative. C) common stocks should offer a higher return than Treasury bonds D) the variance of Treasury bond returns is zero. TRUE/FALSE. Write Tif the statement is true and 'F' if the statement is false. 7) The expected return on an investment includes compensation for both the time value of 7 money and the risks assumed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts