Question: Multiple Choice Questions (60 marks) Clearly circle the best answer to each of the following questions. 1) A portfolio lies on the security market line.

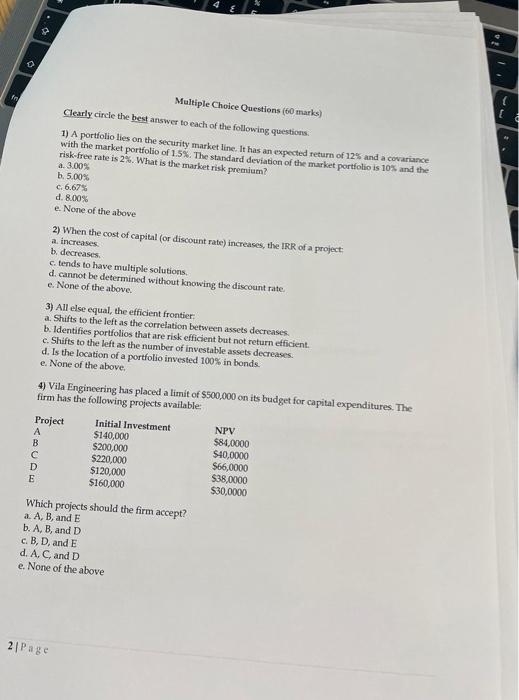

Multiple Choice Questions (60 marks) Clearly circle the best answer to each of the following questions. 1) A portfolio lies on the security market line. It has an expected return of 12% and a covariance with the market portfolio of 1.5%. The standard deviation of the market portfolio is 10% and the risk-free rate is 2%. What is the market risk premium? a. 3.00% b. 5.00% c. 6.67% d. 8.00% e. None of the above 2) When the cost of capital (or discount rate) increases, the IRR of a project a increases b. decreases c. tends to have multiple solutions. d. cannot be determined without knowing the discount rate e. None of the above. 3) All else equal, the efficient frontier a. Shifts to the left as the correlation between assets decreases b. Identifies portfolios that are risk efficient but not return efficient c. Shifts to the left as the number of investable assets decreases. d. Is the location of a portfolio invested 100% in bonds. e None of the above. 4) Vila Engineering has placed a limit of $500,000 on its budget for capital expenditures. The firm has the following projects available: Project Initial Investment NPV $140,000 $84,0000 B $200,000 $40.0000 $220,000 566,0000 D $120,000 $38,0000 E $160,000 $30,0000 Which projects should the firm accept? a. A, B, and E b. A, B, and D c. B, D, and E d. A, C, and D e. None of the above 21 Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts