Question: Multiple choice questions (choose the best answer) 2 points each: 1) The 2014 financial statements of Leggett & Platt, Inc. include the following information in

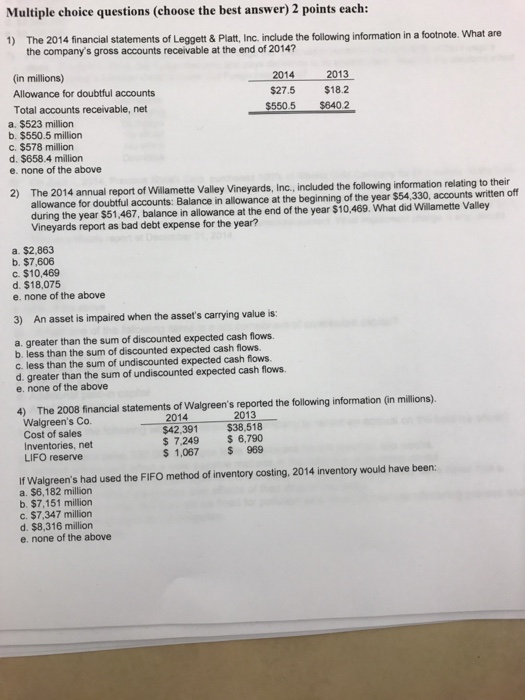

Multiple choice questions (choose the best answer) 2 points each: 1) The 2014 financial statements of Leggett & Platt, Inc. include the following information in a footnote. What are the company's gross accounts receivable at the end of 2014? 2013 2014 (in millions) $27.5 $18.22 Allowance for doubtful accounts $550.5 $640.2 Total accounts receivable, net a. $523 million b. $550.5 million c. $578 million d, $658.4 million e. none of the above 2) The 2014 report valley Vineyards, Inc., included the following information relating to their allowance for doubtful of Willamette beginning of the year $54,330, accounts written off accounts: Balance in allowance at the Valley during the year $51,467, in allowance at the end of the year S10,469. What did Willamette Vineyards report as bad debt expense for the year? a. $2,863 b, $7,606 $10,469 d. $18,075 e, none of the above 3) An asset is impaired when the asset's carrying value iss a. greater than the sum of discounted expected cash flows. b, less than the sum of discounted expected cash flows. c. less than the sum of undiscounted expected cash flows. d. greater than the sum of undiscounted expected cash flows. e. none of the above 4) The 2008 financial statements of Walgreen's reported the following information (n millions). 2014 2013 Walgreen's Co. $38.518 $42.391 Cost of sales 7,249 6,790 Inventories, net 1,067 969 LIFO reserve If Walgreen's had used the FIFo method of inventory costing, 2014 inventory would have been: a. $6,182 million b, $7,151 million c, $7,347 million d. $8,316 million e, none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts