Question: multiple choice questions Question 4 (20 marks): (CLO4: 100%) 17. The cost-effectiveness analysis is used to compare mutually exclusive projects if their cash flows include:

multiple choice questions

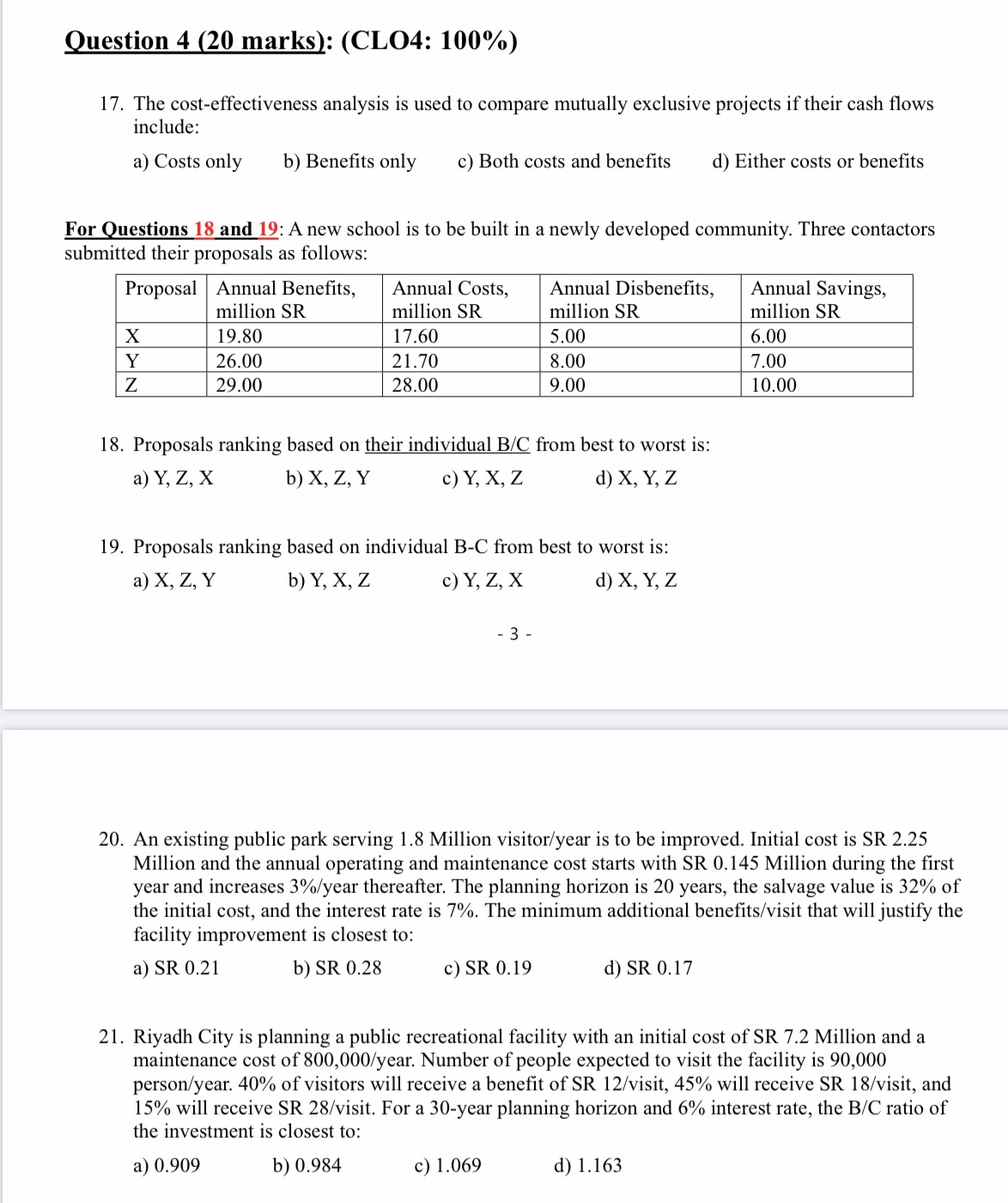

Question 4 (20 marks): (CLO4: 100%) 17. The cost-effectiveness analysis is used to compare mutually exclusive projects if their cash flows include: a) Costs only b) Benefits only c) Both costs and benefits d) Either costs or benefits For Questions 18 and 19: A new school is to be built in a newly developed community. Three contactors submitted their proposals as follows: Proposal | Annual Benefits, Annual Costs, Annual Disbenefits, Annual Savings, million SR million SR million SR million SR X 19.80 17.60 5.00 6.00 Y 26.00 21.70 8.00 7.00 Z 29.00 28.00 9.00 10.00 18. Proposals ranking based on their individual B/C from best to worst is: a ) Y, Z, X b ) X , Z , Y c ) Y, X, Z d) X, Y, Z 19. Proposals ranking based on individual B-C from best to worst is: a ) X, Z, Y b ) Y , X , Z C) Y, Z, X d) X, Y, Z - 3 20. An existing public park serving 1.8 Million visitor/year is to be improved. Initial cost is SR 2.25 Million and the annual operating and maintenance cost starts with SR 0.145 Million during the first year and increases 3%/year thereafter. The planning horizon is 20 years, the salvage value is 32% of the initial cost, and the interest rate is 7%. The minimum additional benefits/visit that will justify the facility improvement is closest to: a) SR 0.21 b) SR 0.28 C) SR 0.19 d) SR 0.17 21. Riyadh City is planning a public recreational facility with an initial cost of SR 7.2 Million and a maintenance cost of 800,000/year. Number of people expected to visit the facility is 90,000 person/year. 40% of visitors will receive a benefit of SR 12/visit, 45% will receive SR 18/visit, and 15% will receive SR 28/visit. For a 30-year planning horizon and 6% interest rate, the B/C ratio of the investment is closest to: a) 0.909 b) 0.984 c) 1.069 d) 1.163

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts