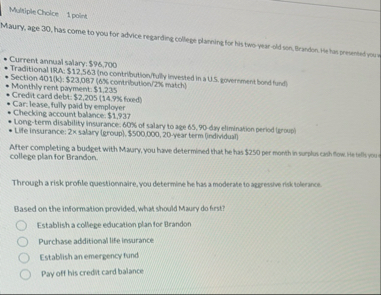

Question: Multiple Cholce 1 point Maury, age 3 0 , has come to you for advice regarding college planning for his two year old son Brandon

Multiple Cholce point

Maury, age has come to you for advice regarding college planning for his two year old son Brandon He lon preverway vour

Current annual salary: $

Traditional IRA: $no contributiontuly invested in a US government bond fund

Section k: $ contribution match

Monthly rent payment. $

Credit card debt: $ foxed

Car: lease, fully paid by employer

Checking account balance: $

Longterm disability insurance, of salary to age diy elimination period growpi

Life insurance: salary eroup $vear term individual

After completing a budget with Maury, you have determined that he has $ per month in surplus cash flow. He tally you college plan for Brandon.

Through a risk profile questionnaire, you determine he has a moderate to aggensive risk tolerance.

Based on the information provided, what should Maury do ferst?

Establish a edlepe education plan for Brandon

Purchase additional life insurance

Establish an emergency fund

Pyy off his credit card balance

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock