Question: Multiple Select Question Select all that apply Which of the following statements is correct regarding real property taxes? Real property taxes are deductible for a

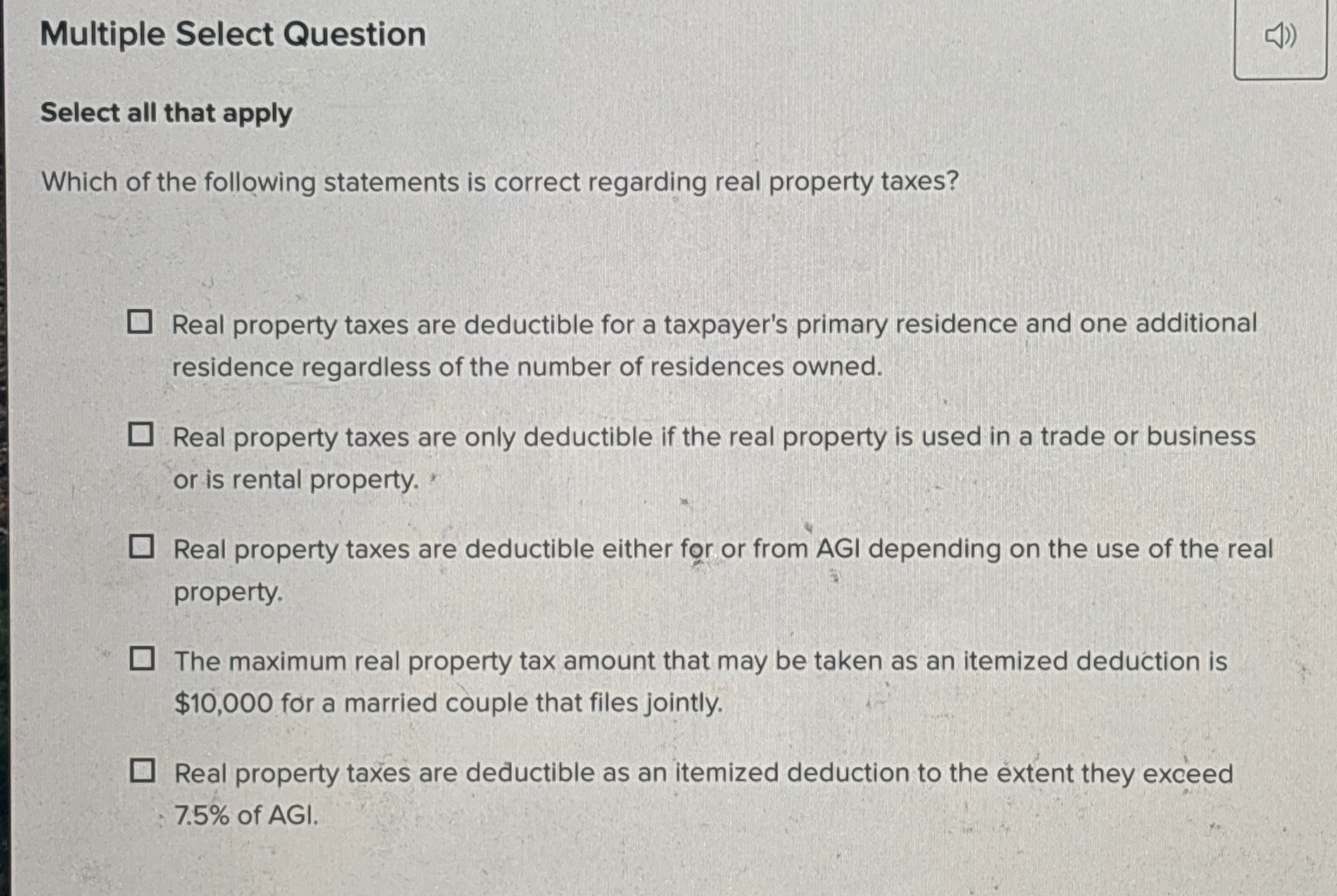

Multiple Select Question

Select all that apply

Which of the following statements is correct regarding real property taxes?

Real property taxes are deductible for a taxpayer's primary residence and one additional residence regardless of the number of residences owned.

Real property taxes are only deductible if the real property is used in a trade or business or is rental property.

Real property taxes are deductible either for or from AGI depending on the use of the real property.

The maximum real property tax amount that may be taken as an itemized deduction is $ for a married couple that files jointly.

Real property taxes are deductible as an itemized deduction to the extent they exceed of AGI.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock