Question: Multiple Select Question Select all that apply Which of the following statements are CORRECT when referring to a home that qualifies as a residence with

Multiple Select Question

Select all that apply

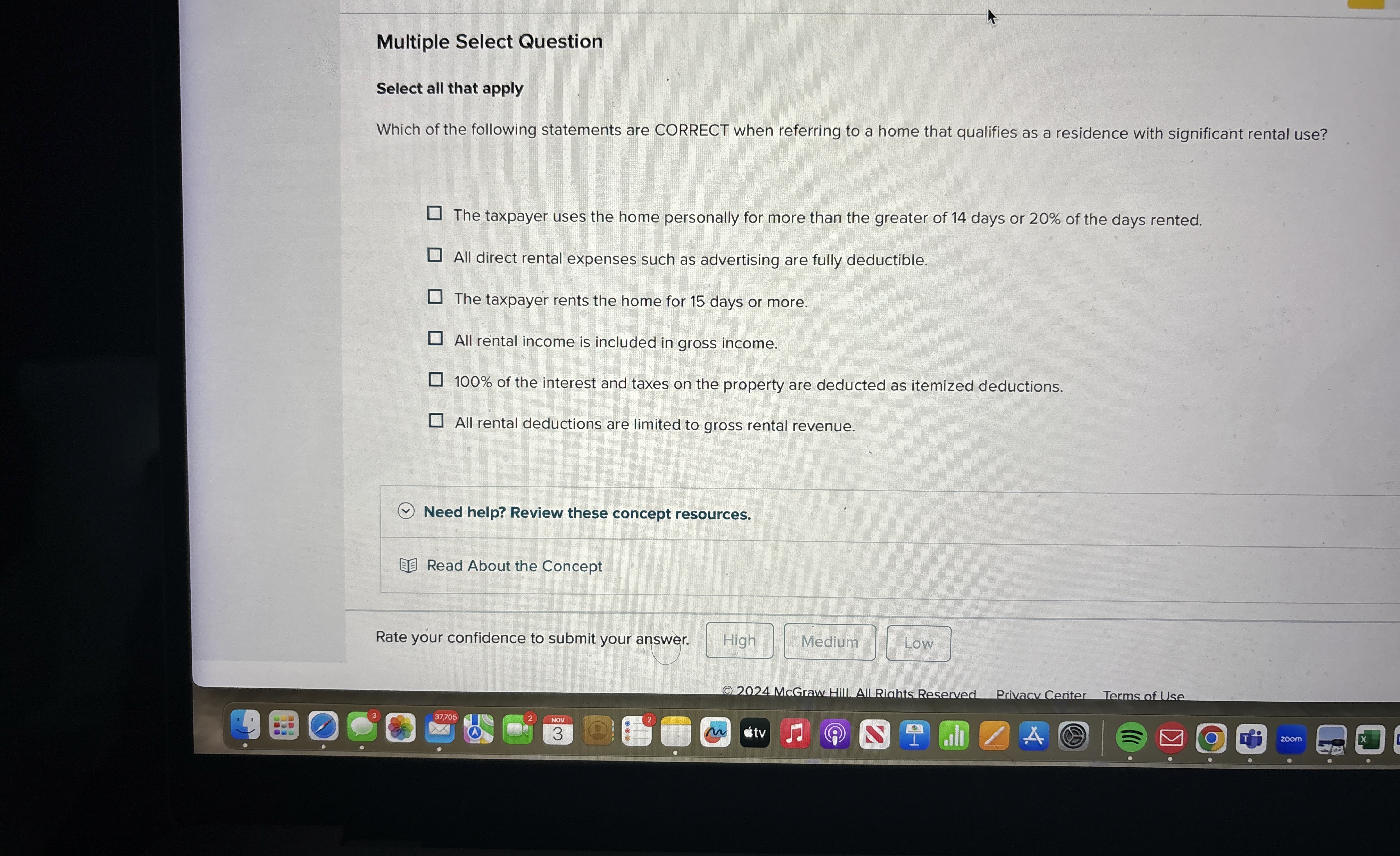

Which of the following statements are CORRECT when referring to a home that qualifies as a residence with significant rental use?

The taxpayer uses the home personally for more than the greater of days or of the days rented.

All direct rental expenses such as advertising are fully deductible.

The taxpayer rents the home for days or more.

All rental income is included in gross income.

of the interest and taxes on the property are deducted as itemized deductions.

All rental deductions are limited to gross rental revenue.

Need help? Review these concept resources.

Read About the Concept

Rate your confidence to submit your answer.

High

Medium

Low

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock