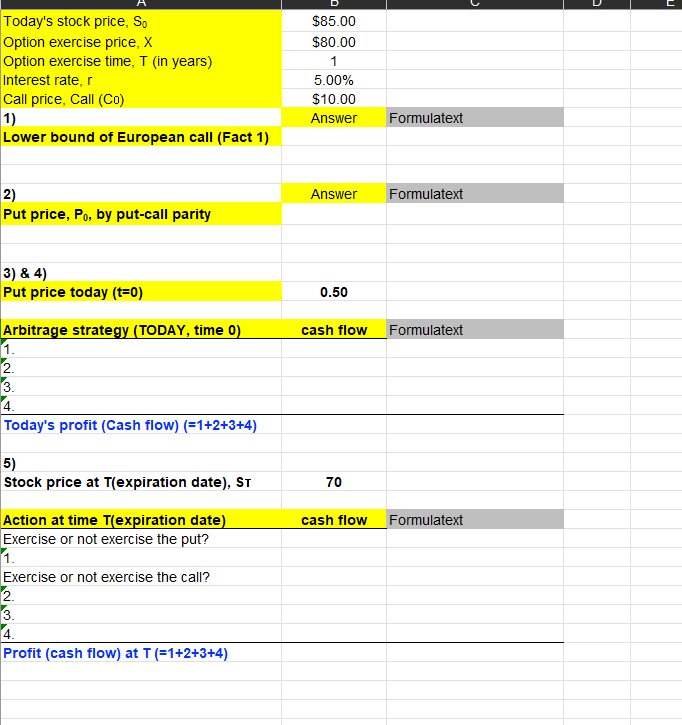

Question: * * * ( MUST ANSWER IN EXCEL w / Functions ) * * * A European call with X = 8 0 and the

MUST ANSWER IN EXCEL w Functions

A European call with X and the time to expiration T of year currently sells for $C The underlying stock price, S is $ The riskfree interest rate is You are considering purchasing a European put option with the same exercise price and expiration date.

The European put option priceP is currently $ Does it violate Fact PutCall Parity If so

provide your arbitrage strategy.

What is your todays profit cash flow

What is your profit cash flow on the expiration date if ST Describe your actions to have each cash flow for your profit on the expiration date.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock