Question: Must be done in EXCEL Ann. Std = .823158 (a) Let's consider a European put option with a strike price of $ 175.00 expiring on

Must be done in EXCEL

Must be done in EXCEL

Ann. Std = .823158

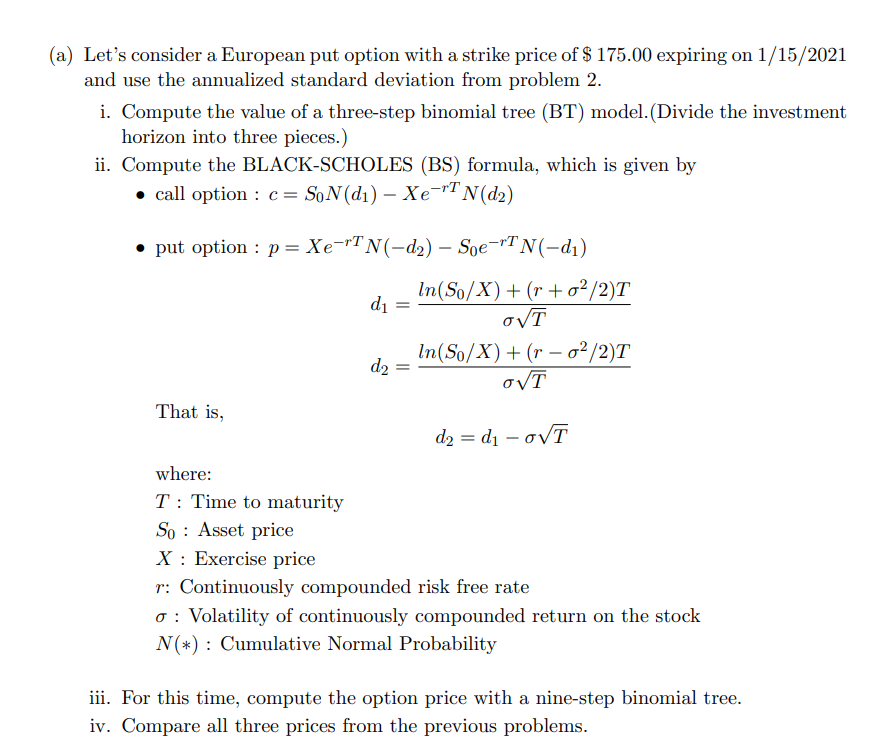

(a) Let's consider a European put option with a strike price of $ 175.00 expiring on 1/15/2021 and use the annualized standard deviation from problem 2. i. Compute the value of a three-step binomial tree (BT) model.(Divide the investment horizon into three pieces.) ii. Compute the BLACK-SCHOLES (BS) formula, which is given by call option : C= SoN(d1) - Xe-TN(d2) put option : p= Xe-rTN-d2) Soe-TN-d) 2. _In(So/X) + (r + 02/2)T OVT In(So/X) + (r - 02/2)T OVT That is, d2 = d - OVT where: T: Time to maturity So : Asset price X : Exercise price r: Continuously compounded risk free rate 0 : Volatility of continuously compounded return on the stock N(*): Cumulative Normal Probability iii. For this time, compute the option price with a nine-step binomial tree. iv. Compare all three prices from the previous problems. (a) Let's consider a European put option with a strike price of $ 175.00 expiring on 1/15/2021 and use the annualized standard deviation from problem 2. i. Compute the value of a three-step binomial tree (BT) model.(Divide the investment horizon into three pieces.) ii. Compute the BLACK-SCHOLES (BS) formula, which is given by call option : C= SoN(d1) - Xe-TN(d2) put option : p= Xe-rTN-d2) Soe-TN-d) 2. _In(So/X) + (r + 02/2)T OVT In(So/X) + (r - 02/2)T OVT That is, d2 = d - OVT where: T: Time to maturity So : Asset price X : Exercise price r: Continuously compounded risk free rate 0 : Volatility of continuously compounded return on the stock N(*): Cumulative Normal Probability iii. For this time, compute the option price with a nine-step binomial tree. iv. Compare all three prices from the previous problems

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts