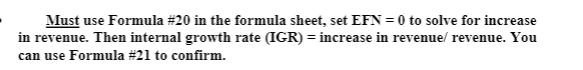

Question: Must use Formula #20 in the formula sheet, set EFN=0 to solve for increase in revenue. Then internal growth rate (IGR) = increase in

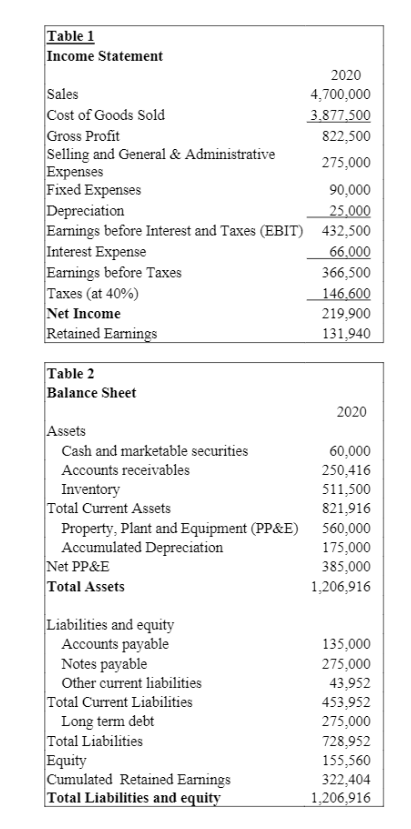

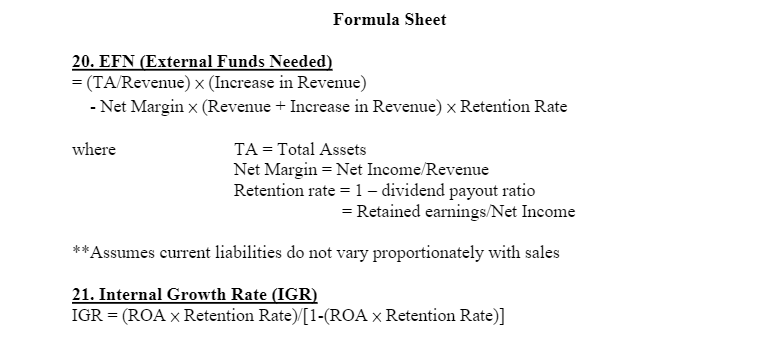

Must use Formula #20 in the formula sheet, set EFN=0 to solve for increase in revenue. Then internal growth rate (IGR) = increase in revenue/ revenue. You can use Formula #21 to confirm. Table 1 Income Statement 2020 Sales 4,700,000 Cost of Goods Sold 3,877,500 Gross Profit 822,500 Selling and General & Administrative 275,000 Expenses Fixed Expenses 90,000 Depreciation 25,000 Earnings before Interest and Taxes (EBIT) 432,500 Interest Expense Earnings before Taxes Taxes (at 40%) Net Income Retained Earnings 66,000 366,500 146,600 219,900 131,940 Table 2 Balance Sheet 2020 Assets Cash and marketable securities 60,000 Accounts receivables 250,416 Inventory 511,500 Total Current Assets 821,916 Property, Plant and Equipment (PP&E) 560,000 Accumulated Depreciation 175,000 Net PP&E 385,000 Total Assets 1,206,916 Liabilities and equity Accounts payable 135,000 Notes payable 275,000 Other current liabilities 43,952 Total Current Liabilities 453,952 Long term debt 275,000 Total Liabilities 728,952 Equity Cumulated Retained Earnings Total Liabilities and equity 155,560 322,404 1,206,916 20. EFN (External Funds Needed) Formula Sheet = (TA/Revenue) x (Increase in Revenue) -Net Margin x (Revenue + Increase in Revenue) x Retention Rate where ** TA = Total Assets Net Margin = Net Income/Revenue Retention rate 1 - dividend payout ratio = Retained earnings/Net Income *Assumes current liabilities do not vary proportionately with sales 21. Internal Growth Rate (IGR) IGR = (ROA x Retention Rate)/[1-(ROA Retention Rate)]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts