Question: Mutual Funds - Load Load Return Mutual Funds - No Load No Load Return American National Growth 15.71 Amana Income Fund 11.24 Arch Small Cap

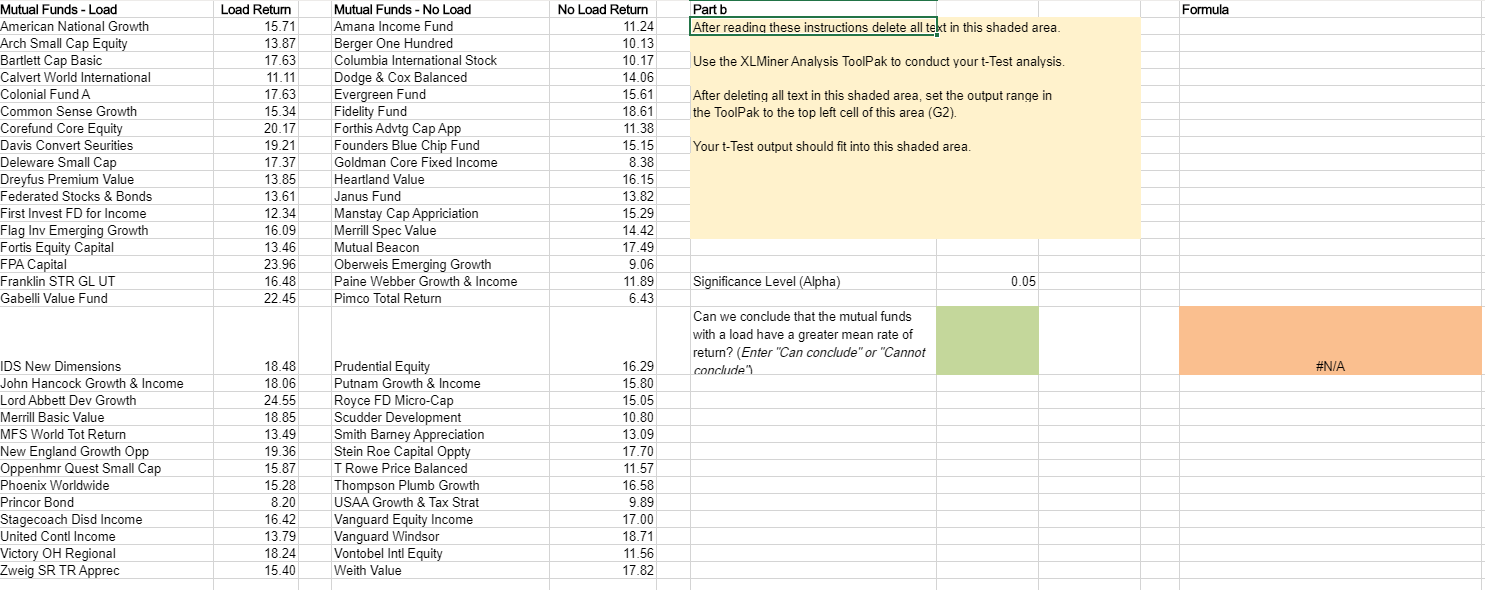

| Mutual Funds - Load | Load Return | Mutual Funds - No Load | No Load Return | |

| American National Growth | 15.71 | Amana Income Fund | 11.24 | |

| Arch Small Cap Equity | 13.87 | Berger One Hundred | 10.13 | |

| Bartlett Cap Basic | 17.63 | Columbia International Stock | 10.17 | |

| Calvert World International | 11.11 | Dodge & Cox Balanced | 14.06 | |

| Colonial Fund A | 17.63 | Evergreen Fund | 15.61 | |

| Common Sense Growth | 15.34 | Fidelity Fund | 18.61 | |

| Corefund Core Equity | 20.17 | Forthis Advtg Cap App | 11.38 | |

| Davis Convert Seurities | 19.21 | Founders Blue Chip Fund | 15.15 | |

| Deleware Small Cap | 17.37 | Goldman Core Fixed Income | 8.38 | |

| Dreyfus Premium Value | 13.85 | Heartland Value | 16.15 | |

| Federated Stocks & Bonds | 13.61 | Janus Fund | 13.82 | |

| First Invest FD for Income | 12.34 | Manstay Cap Appriciation | 15.29 | |

| Flag Inv Emerging Growth | 16.09 | Merrill Spec Value | 14.42 | |

| Fortis Equity Capital | 13.46 | Mutual Beacon | 17.49 | |

| FPA Capital | 23.96 | Oberweis Emerging Growth | 9.06 | |

| Franklin STR GL UT | 16.48 | Paine Webber Growth & Income | 11.89 | |

| Gabelli Value Fund | 22.45 | Pimco Total Return | 6.43 | |

| IDS New Dimensions | 18.48 | Prudential Equity | 16.29 | |

| John Hancock Growth & Income | 18.06 | Putnam Growth & Income | 15.80 | |

| Lord Abbett Dev Growth | 24.55 | Royce FD Micro-Cap | 15.05 | |

| Merrill Basic Value | 18.85 | Scudder Development | 10.80 | |

| MFS World Tot Return | 13.49 | Smith Barney Appreciation | 13.09 | |

| New England Growth Opp | 19.36 | Stein Roe Capital Oppty | 17.70 | |

| Oppenhmr Quest Small Cap | 15.87 | T Rowe Price Balanced | 11.57 | |

| Phoenix Worldwide | 15.28 | Thompson Plumb Growth | 16.58 | |

| Princor Bond | 8.20 | USAA Growth & Tax Strat | 9.89 | |

| Stagecoach Disd Income | 16.42 | Vanguard Equity Income | 17.00 | |

| United Contl Income | 13.79 | Vanguard Windsor | 18.71 | |

| Victory OH Regional | 18.24 | Vontobel Intl Equity | 11.56 | |

| Zweig SR TR Apprec | 15.40 | Weith Value | 17.82 |

| Significance Level (Alpha) | 0.05 |

Mutual funds are classified as load or no-load funds. Load funds require an investor to pay an initial fee based on a percentage of the amount invested in the fund. The no-load funds do not require this initial fee. Some financial advisors argue that the load mutual funds may be worth the extra fee because these funds provide a higher mean rate of return than the no-load mutual funds. A sample of 30 load mutual funds and a sample of 30 no-load mutual funds selected for analysis are contained in the Excel Online file below. Data were collected on the annual return for the funds over a five-year period. Construct a spreadsheet to answer the following questions. XEE Open spreadsheet a. Formulate Ho and H, such that rejection of Ho leads to the conclusion that the load mutual funds have a higher mean annual return over the five-year period. vo Ho: Mload - Mino-load H: Mload - Mono-load vo b. Use the 60 mutual funds in the table above to conduct the hypothesis test. What is the p-value? p-value is (to 4 decimals) At a= .05, what is your conclusion? that the mutual funds with a load have a greater mean rate of return. Formula Part b After reading these instructions delete all tekt in this shaded area. Load Return 15.71 13.87 17.63 11.11 17.63 15.34 20.17 Use the XLMiner Analysis ToolPak to conduct your t-Test analysis. After deleting all text in this shaded area, set the output range in the ToolPak to the top left cell of this area (G2). 19.21 Mutual Funds - Load American National Growth Arch Small Cap Equity Bartlett Cap Basic Calvert World International Colonial Fund A Common Sense Growth Corefund Core Equity Davis Convert Seurities Deleware Small Cap Dreyfus Premium Value Federated Stocks & Bonds First Invest FD for Income Flag Inv Emerging Growth Fortis Equity Capital FPA Capital Franklin STR GLUT Gabelli Value Fund Mutual Funds - No Load Amana Income Fund Berger One Hundred Columbia International Stock Dodge & Cox Balanced Evergreen Fund Fidelity Fund Forthis Advtg Cap App Founders Blue Chip Fund Goldman Core Fixed Income Heartland Value Janus Fund Manstay Cap Appriciation Merrill Spec Value Mutual Beacon Oberweis Emerging Growth Paine Webber Growth & Income Pimco Total Return Your t-Test output should fit into this shaded area. No Load Return 11.24 10.13 10.17 14.06 15.61 18.61 11.38 15.15 8.38 16.15 13.82 15.29 14.42 17.49 9.06 11.89 6.43 17.37 13.85 13.61 12.34 16.09 13.46 23.96 16.48 22.45 Significance Level (Alpha) 0.05 Can we conclude that the mutual funds with a load have a greater mean rate of return? (Enter "Can conclude" or "Cannot conclude" #N/A IDS New Dimensions John Hancock Growth & Income Lord Abbett Dev Growth Merrill Basic Value MFS World Tot Return New England Growth Opp Oppenhmr Quest Small Cap Phoenix Worldwide Princor Bond Stagecoach Disd Income United Conti Income Victory OH Regional Zweig SR TR Apprec 18.48 18.06 24.55 18.85 13.49 19.36 15.87 15.28 8.20 16.42 13.79 18.24 15.40 Prudential Equity Putnam Growth & Income Royce FD Micro-Cap Scudder Development Smith Barney Appreciation Stein Roe Capital Oppty T Rowe Price Balanced Thompson Plumb Growth USAA Growth & Tax Strat Vanguard Equity Income Vanguard Windsor Vontobel Intl Equity Weith Value 16.29 15.80 15.05 10.80 13.09 17.70 11.57 16.58 9.89 17.00 18.71 11.56 17.82 Mutual funds are classified as load or no-load funds. Load funds require an investor to pay an initial fee based on a percentage of the amount invested in the fund. The no-load funds do not require this initial fee. Some financial advisors argue that the load mutual funds may be worth the extra fee because these funds provide a higher mean rate of return than the no-load mutual funds. A sample of 30 load mutual funds and a sample of 30 no-load mutual funds selected for analysis are contained in the Excel Online file below. Data were collected on the annual return for the funds over a five-year period. Construct a spreadsheet to answer the following questions. XEE Open spreadsheet a. Formulate Ho and H, such that rejection of Ho leads to the conclusion that the load mutual funds have a higher mean annual return over the five-year period. vo Ho: Mload - Mino-load H: Mload - Mono-load vo b. Use the 60 mutual funds in the table above to conduct the hypothesis test. What is the p-value? p-value is (to 4 decimals) At a= .05, what is your conclusion? that the mutual funds with a load have a greater mean rate of return. Formula Part b After reading these instructions delete all tekt in this shaded area. Load Return 15.71 13.87 17.63 11.11 17.63 15.34 20.17 Use the XLMiner Analysis ToolPak to conduct your t-Test analysis. After deleting all text in this shaded area, set the output range in the ToolPak to the top left cell of this area (G2). 19.21 Mutual Funds - Load American National Growth Arch Small Cap Equity Bartlett Cap Basic Calvert World International Colonial Fund A Common Sense Growth Corefund Core Equity Davis Convert Seurities Deleware Small Cap Dreyfus Premium Value Federated Stocks & Bonds First Invest FD for Income Flag Inv Emerging Growth Fortis Equity Capital FPA Capital Franklin STR GLUT Gabelli Value Fund Mutual Funds - No Load Amana Income Fund Berger One Hundred Columbia International Stock Dodge & Cox Balanced Evergreen Fund Fidelity Fund Forthis Advtg Cap App Founders Blue Chip Fund Goldman Core Fixed Income Heartland Value Janus Fund Manstay Cap Appriciation Merrill Spec Value Mutual Beacon Oberweis Emerging Growth Paine Webber Growth & Income Pimco Total Return Your t-Test output should fit into this shaded area. No Load Return 11.24 10.13 10.17 14.06 15.61 18.61 11.38 15.15 8.38 16.15 13.82 15.29 14.42 17.49 9.06 11.89 6.43 17.37 13.85 13.61 12.34 16.09 13.46 23.96 16.48 22.45 Significance Level (Alpha) 0.05 Can we conclude that the mutual funds with a load have a greater mean rate of return? (Enter "Can conclude" or "Cannot conclude" #N/A IDS New Dimensions John Hancock Growth & Income Lord Abbett Dev Growth Merrill Basic Value MFS World Tot Return New England Growth Opp Oppenhmr Quest Small Cap Phoenix Worldwide Princor Bond Stagecoach Disd Income United Conti Income Victory OH Regional Zweig SR TR Apprec 18.48 18.06 24.55 18.85 13.49 19.36 15.87 15.28 8.20 16.42 13.79 18.24 15.40 Prudential Equity Putnam Growth & Income Royce FD Micro-Cap Scudder Development Smith Barney Appreciation Stein Roe Capital Oppty T Rowe Price Balanced Thompson Plumb Growth USAA Growth & Tax Strat Vanguard Equity Income Vanguard Windsor Vontobel Intl Equity Weith Value 16.29 15.80 15.05 10.80 13.09 17.70 11.57 16.58 9.89 17.00 18.71 11.56 17.82

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts