Question: My answer 4 and 5 are incorrect, need help You are considering two mutually exclusive projects, A and B. Project A costs $50,000 and generates

My answer 4 and 5 are incorrect, need help

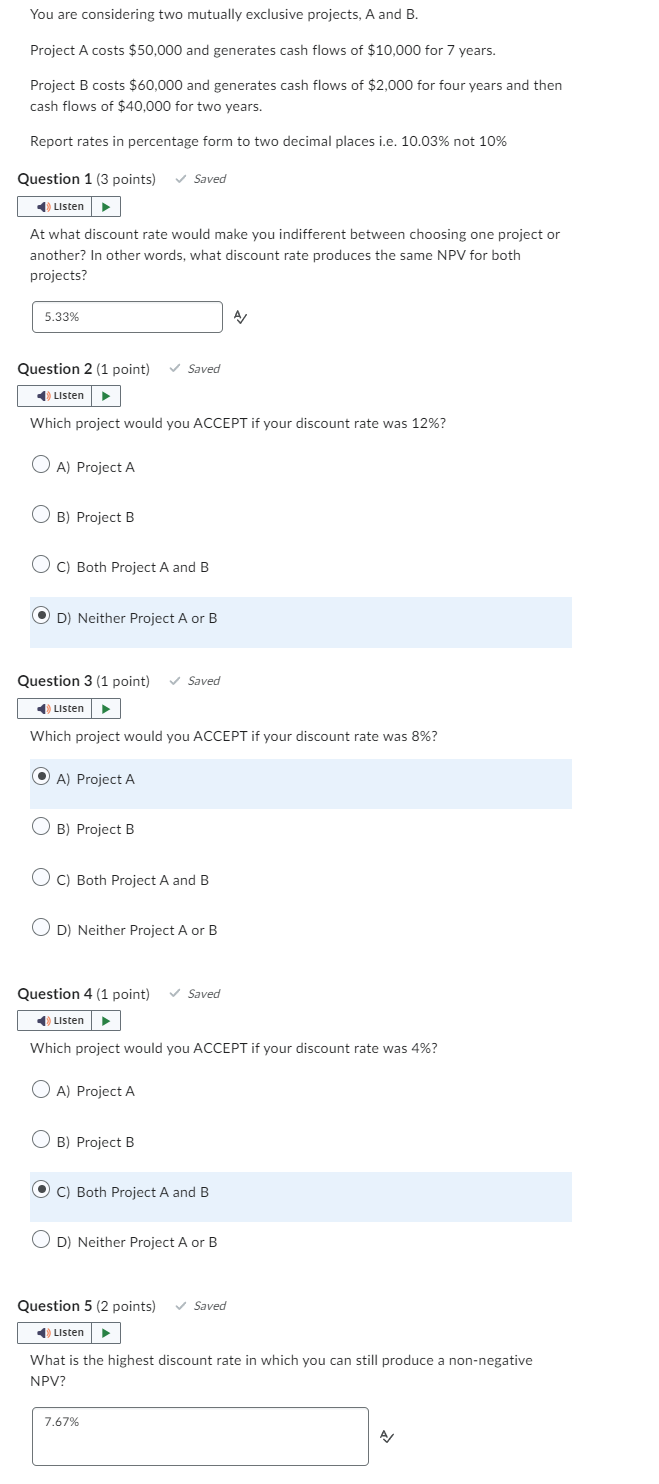

You are considering two mutually exclusive projects, A and B. Project A costs $50,000 and generates cash flows of $10,000 for 7 years. Project B costs $60,000 and generates cash flows of $2,000 for four years and then cash flows of $40,000 for two years. Report rates in percentage form to two decimal places i.e. 10.03% not 10% Question 1 (3 points) Saved At what discount rate would make you indifferent between choosing one project or another? In other words, what discount rate produces the same NPV for both projects? A Question 2 (1 point) Saved Which project would you ACCEPT if your discount rate was 12% ? A) Project A B) Project B C) Both Project A and B D) Neither Project A or B Question 3 Which project would you ACCEPT if your discount rate was 8% ? A) Project A B) Project B C) Both Project A and B D) Neither Project A or B Question 4 (1 point) Saved ] Which project would you ACCEPT if your discount rate was 4% ? A) Project A B) Project B C) Both Project A and B D) Neither Project A or B Question 5 (2 points) Saved What is the highest discount rate in which you can still produce a non-negative NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts