Question: my answer key says 4% for the answer to A, but I keep getting 8%, would appreciate the work shown F303: Intermediate Investments Problem Set

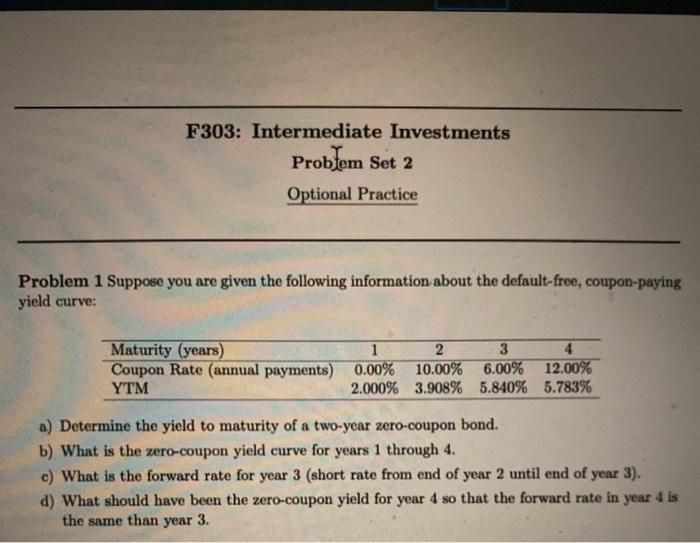

F303: Intermediate Investments Problem Set 2 Optional Practice Problem 1 Suppose you are given the following information about the default-free, coupon-paying yield curve: Maturity (years) 1 2 3 4 Coupon Rate (annual payments) 0.00% 10.00% 6.00% 12.00% YTM 2.000% 3.908% 5.840% 5.783% a) Determine the yield to maturity of a two-year zero-coupon bond. b) What is the zero-coupon yield curve for years 1 through 4. c) What is the forward rate for year 3 (short rate from end of year 2 until end of year 3). d) What should have been the zero-coupon yield for year 4 so that the forward rate in year 4 is the same than year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts