Question: Please answer 28,29,&30. 28. Assume that the covered interest arbitrage due to high interest rates on Canadian dollars. Which of following forces should result from

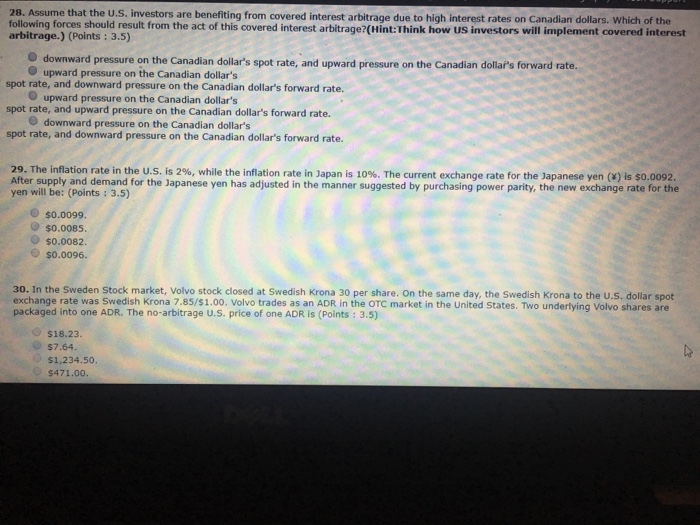

28. Assume that the covered interest arbitrage due to high interest rates on Canadian dollars. Which of following forces should result from the act of this covered interest arbitrage?(Hint:Think how US investors will implement covered interest arbitrage.) (Points: 3.5) O downward pressure on the Canadian dollar's spot rate, and upward pressure on the Canadian dolilar's forward rate. O upward pressure on the Canadian dollar's upward pressure on the Canadian dollar's O downward pressure on the Canadian dollar's spot rate, and downward pressure on the Canadian dollar's forward rate. spot rate, and upward pressure on the Canadian dollar's forward rate. spot rate, and downward pressure on the Canadian dollar's forward rate. 29. The inflation rate in the US is 2%, while the inflation rate in Japan is 10% The current exchange rate for the Japanese yen y is so 0092. yen will be: (Points : 3.5) After supply and demand for the lapanese yen has adjusted in the manner suested y r casing power party, the new exchange rate for the $0.0099 $0.0085. O s0.0082. O s0.0096. 30. In the Sweden Stock market, Volvo stock closed at Swedish Krona 30 per share. On the same day, the Swedish Krona to the U.S. dollar spot exchange rate was Swedish Krona 7.85/$1.00. Volvo trades as an ADR in the OTC market in the United States. Two underlying Volvo shares are packaged into one ADR. The no-arbitrage U.S. price of one ADR is (Points : 3.5) O $18.23 $7.64. $1,234.50. $471.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts