Question: My Course - PRINCIPLES OF learning.com / ihub / learningcurve / f 1 8 8 d 9 5 0 - dd 7 3 - 1

My Course PRINCIPLES OF

learning.comihublearningcurvefdddecaccdaefcbaaecdcdeeaeae

e: Saving and Investment

Score:

Question Value:

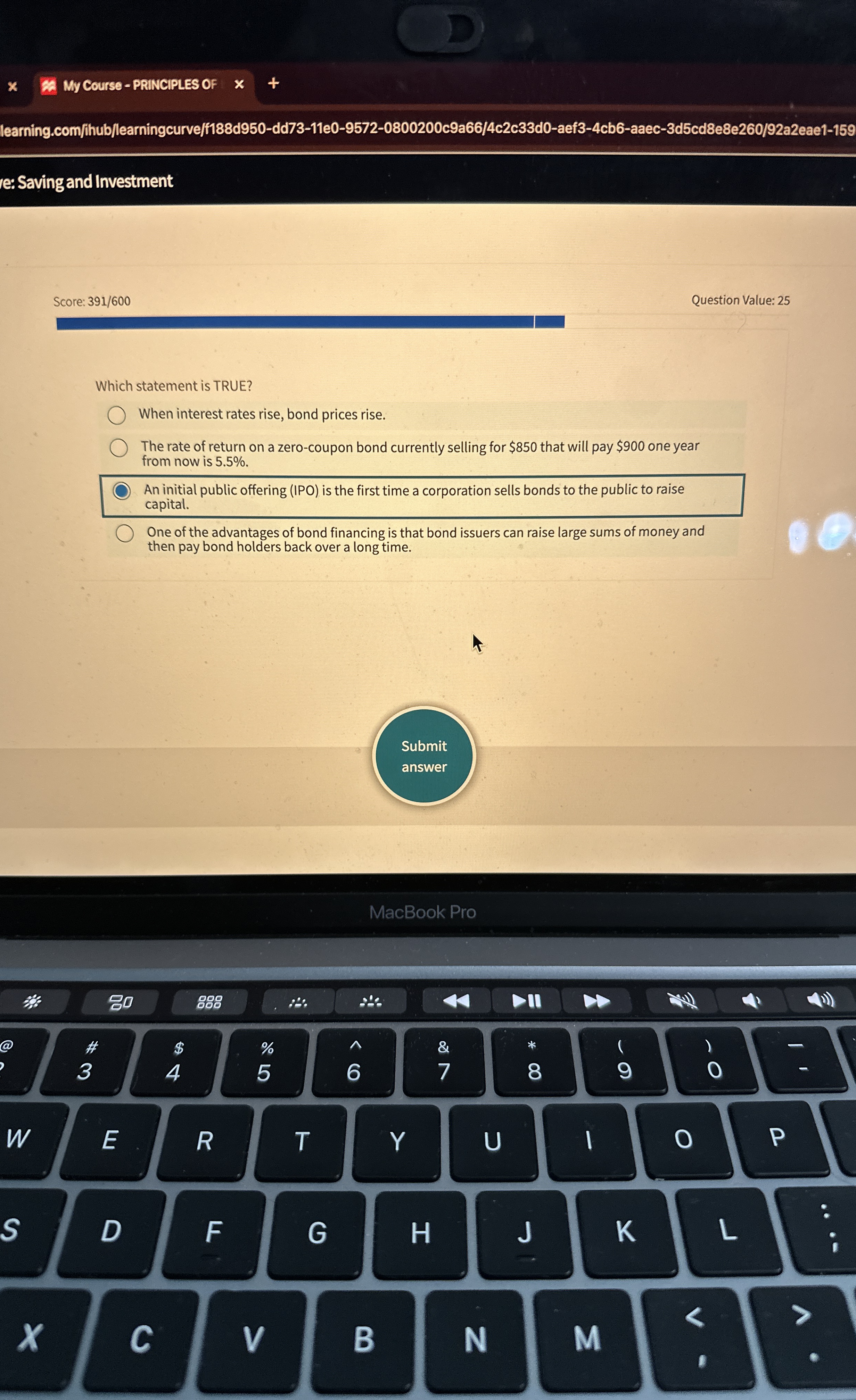

Which statement is TRUE?

When interest rates rise, bond prices rise.

The rate of return on a zerocoupon bond currently selling for $ that will pay $ one year from now is

An initial public offering IPO is the first time a corporation sells bonds to the public to raise capital.

One of the advantages of bond financing is that bond issuers can raise large sums of money and then pay bond holders back over a long time.

Submit

answer

MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock