Question: my question is : (1) why is the staff training cost not included in the operating expenses of the statement of comprehensive income? (1a) Using

my question is :

(1) why is the staff training cost not included in the operating expenses of the statement of comprehensive income?

(1a) Using the trial balance and Statement of Comprehensive Income prepared, please prepare the Statement of Financial Position as at 31 December 2019 for ABC Sdn Bhd.

| Unadjusted Balance | Adjustments | Adjusted Balance | ||||||||

| (Dr) RM | (Cr) RM | (Dr) RM | (Cr) RM | (Dr) RM | (Cr) RM | |||||

| Land | 500,000 | 500,000 | ||||||||

| Building | 200,000 | 200,000 | ||||||||

| Motor vehicles | 120,000 | 1,000 | 119,000 | |||||||

| Plant and machinery | 70,000 | 70,000 | ||||||||

| Retained profit | 312,150 | 312,150 | ||||||||

| 8% Debenture | 150,000 | 150,000 | ||||||||

| Ordinary share | 200,000 | 200,000 | ||||||||

| Accumulated depreciation on: | ||||||||||

| Building | 60,000 | 60,000 | ||||||||

| Motor vehicles | 69,250 | 69,250 | ||||||||

| Plant and machinery | 40,000 | 40,000 | ||||||||

| Sales returns | 3,600 | 3,600 | ||||||||

| Purchase returns | 4,100 | 4,100 | ||||||||

| Sales | 700,000 | 700,000 | ||||||||

| Purchases | 400,000 | 400,000 | ||||||||

| Sales discount | 5,000 | 2,000 | 3,000 | |||||||

| Purchase discounts | 3,500 | 2,000 | 1500 | |||||||

| Opening inventory | 52,000 | 52,000 | ||||||||

| 7% preference shares | 50,000 | 50,000 | ||||||||

| Provision for bad debts | 2,000 | 2,000 | ||||||||

| Trade receivables | 26,700 | 3,800 | 30,500 | |||||||

| Trade payable | 43,200 | 43,200 | ||||||||

| Administrative expenses | 18,000 | 500 | 18,500 | |||||||

| Staff training cost | 4,000 | 4,000 | ||||||||

| Bad debts | 12,500 | 12,500 | ||||||||

| Motor expenses | 27,000 | 1,000 | 28,000 | |||||||

| Rental | 90,000 | 90,000 | ||||||||

| Bank overdraft | 15,400 | 500 | 15,900 | |||||||

| Wages and Salaries | 115,000 | 115,000 | ||||||||

| Debenture interest | 6,000 | 6,000 | ||||||||

| Suspense account | 200 | 4,000 | ||||||||

| 1,649,800 | 1649800 | 7300 | 3500 | 1,652,100 | 1652100 | |||||

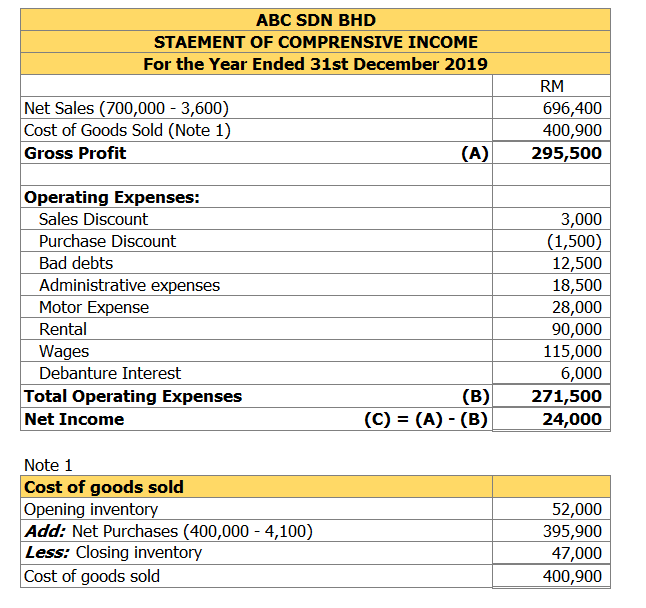

ABC SDN BHD STAEMENT OF COMPRENSIVE INCOME For the Year Ended 31st December 2019 Net Sales (700,000 - 3,600) Cost of Goods Sold (Note 1) Gross Profit RM 696,400 400,900 295,500 (A) Operating Expenses: Sales Discount Purchase Discount Bad debts Administrative expenses Motor Expense Rental Wages Debanture Interest Total Operating Expenses Net Income 3,000 (1,500 12,500 18,500 28,000 90,000 115,000 6,000 271,500 24,000 (B) (C) = (A) -(B) Note 1 Cost of goods sold Opening inventory Add: Net Purchases (400,000 - 4,100 Less: Closing inventory Cost of goods sold 52,000 395,900 47,000 400,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts