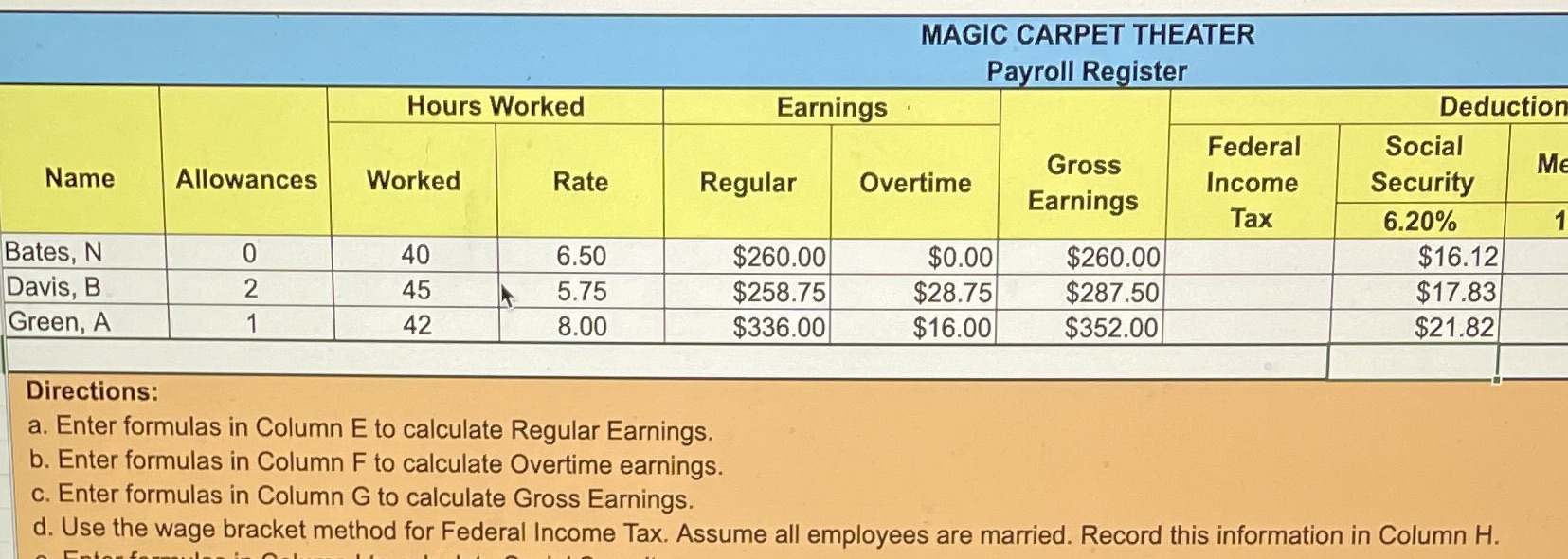

Question: My question is on question D. It says use the wage bracket method for federal income tax what numbers would I input for this column.

My question is on question D. It says use the wage bracket method for federal income tax what numbers would I input for this column. How do find out what number that is

MAGIC CARPET THEATER Payroll Register Hours Worked Earnings Deduction Federal Social Gross ME Name Allowances Worked Rate Regular Overtime Income Security Earnings Tax 6.20% Bates, N 0 40 6.50 $260.00 $0.00 $260.00 $16.12 Davis, B 2 45 5.75 $258.75 $28.75 $287.50 $17.83 Green, A 1 42 8.00 $336.00 $16.00 $352.00 $21.82 Directions: a. Enter formulas in Column E to calculate Regular Earnings. b. Enter formulas in Column F to calculate Overtime earnings. c. Enter formulas in Column G to calculate Gross Earnings. d. Use the wage bracket method for Federal Income Tax. Assume all employees are married. Record this information in Column H

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts